Punjab Asaan Karobar Card Scheme – How to Apply Online Application in AKC Portal 2026

The Punjab government’s Asaan Karobar Card is a major initiative to support small business owners and entrepreneurs. This program offers interest-free loans starting from PKR 1 million and going up to PKR 30 million, making it easier for SMEs to grow and manage their businesses at any scale. With digital tools and a transparent process, the Asaan Karobar Card is empowering businesses across Punjab to thrive.

Loan Calculator

Calculation Results

- Tier 1: PKR 100,000 - 5,000,000 (Processing Fee: PKR 5,000)

- Tier 2: PKR 5,000,000 - 30,000,000 (Processing Fee: PKR 10,000)

- Interest Rate: Competitive rates as per SBP guidelines

- Repayment: Flexible monthly installments

📱 1786 (Toll Free)

🕒 9:00 AM - 5:00 PM

📍 Punjab Small Industries Corporation

Lahore, Punjab

What is the maximum loan amount?

What documents are required?

How long does the approval process take?

Personal Documents:

- CNIC (Front & Back)

- Passport Size Photo

- Income Certificate

- Bank Statements (6 months)

Business Documents:

- Business Registration

- Trade License

- Tax Returns (2 years)

- Business Plan

Financing

To 30M

Terms

Monthly EMIs

Processing

What is Asaan Karobar Card Online

The Asaan Karobar Card is a unique financial tool introduced by the Punjab government to help small business owners and aspiring entrepreneurs access much-needed capital. Through this card, eligible individuals can receive interest-free loans starting from PKR 1 million and going up to PKR 30 million, which can be used to start a new business or expand an existing one.

The entire process is managed digitally, ensuring transparency and convenience at every step. By removing the burden of interest and simplifying access to funds, the Asaan Karobar Card is opening new doors for business growth and economic progress throughout Punjab.

News: For the latest update on the Asaan Karobar Card, check out the newspaper clipping below for all the new details.

How to Register for Asaan Karobar Card Online

Registering for the Asaan Karobar Card is quick and straightforward. Follow steps:

Go to the Official Website

- Visit akc.punjab.gov.pk.

- Click “Register Now.”

Fill in Your Details

- Enter your full name as on your CNIC.

- Add your CNIC number and date of birth.

- Include your father’s or husband’s name.

- Fill in your CNIC issue and expiry dates.

- Enter your mobile number (must be in your name).

- Create a strong password.

Review and Submit

- Double-check your information.

- Click “Register” to complete the process

- You’ll get a confirmation SMS on your phone.

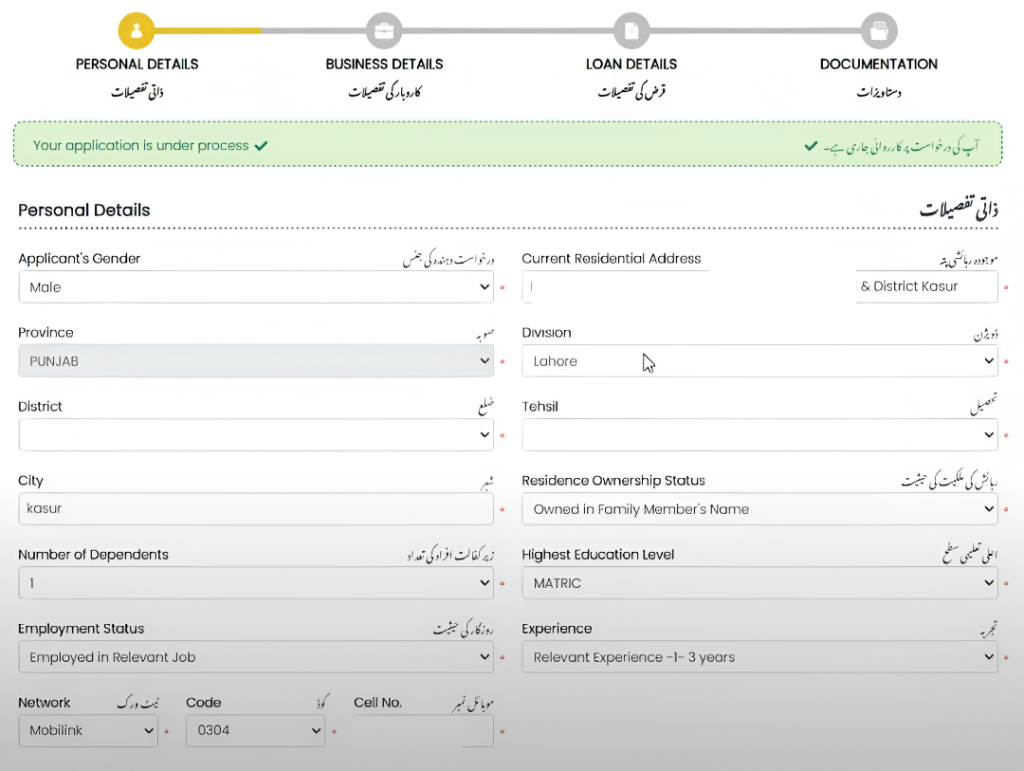

How to Apply for Asaan Karobar Card

After registering, you can Apply for the Card:

Login to Your Account

- Go back to akc.punjab.gov.pk.

- Click “Login.”

- Enter your CNIC and password.

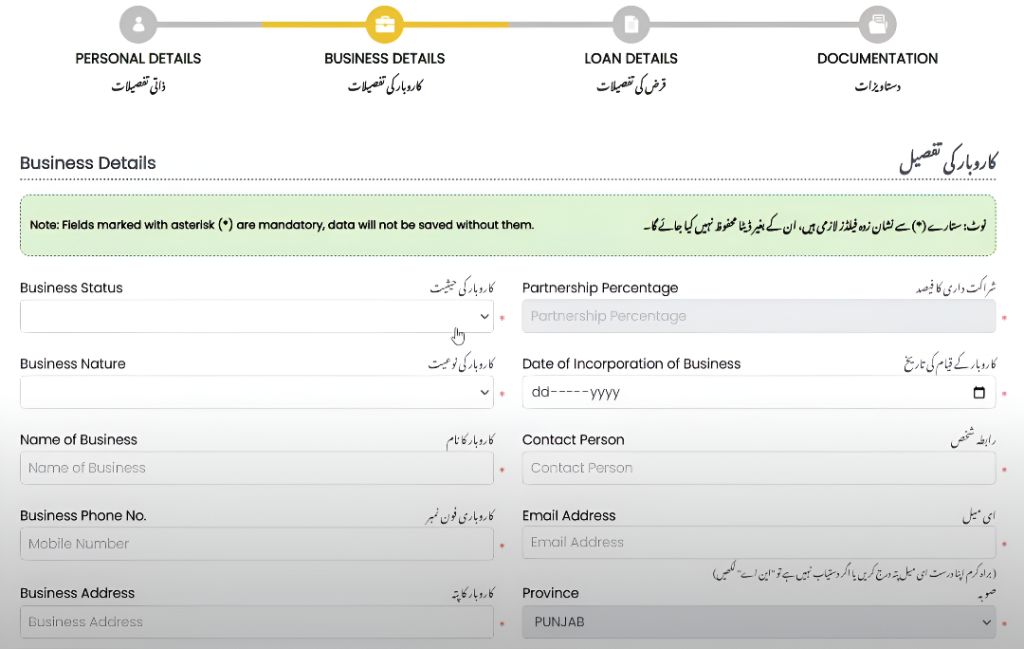

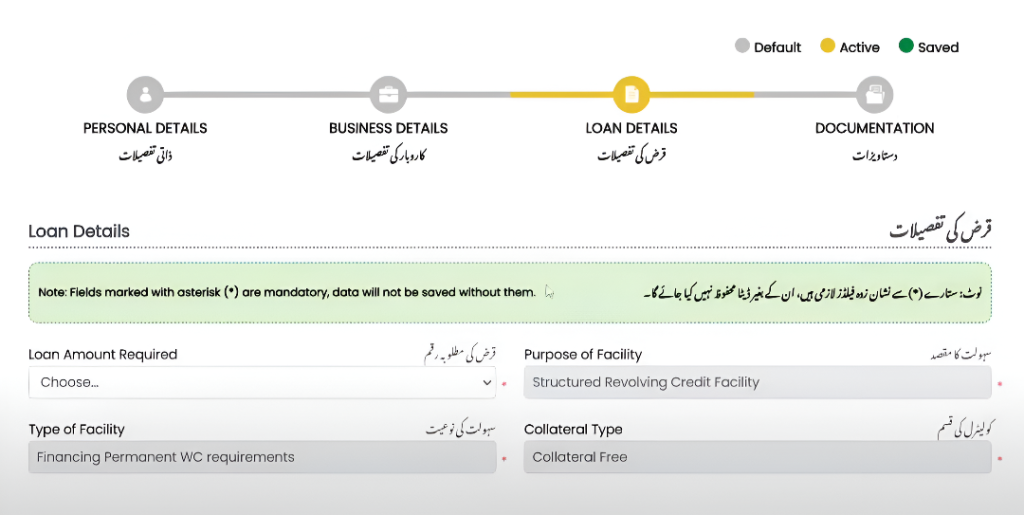

Fill the Application Form

- Add your business details.

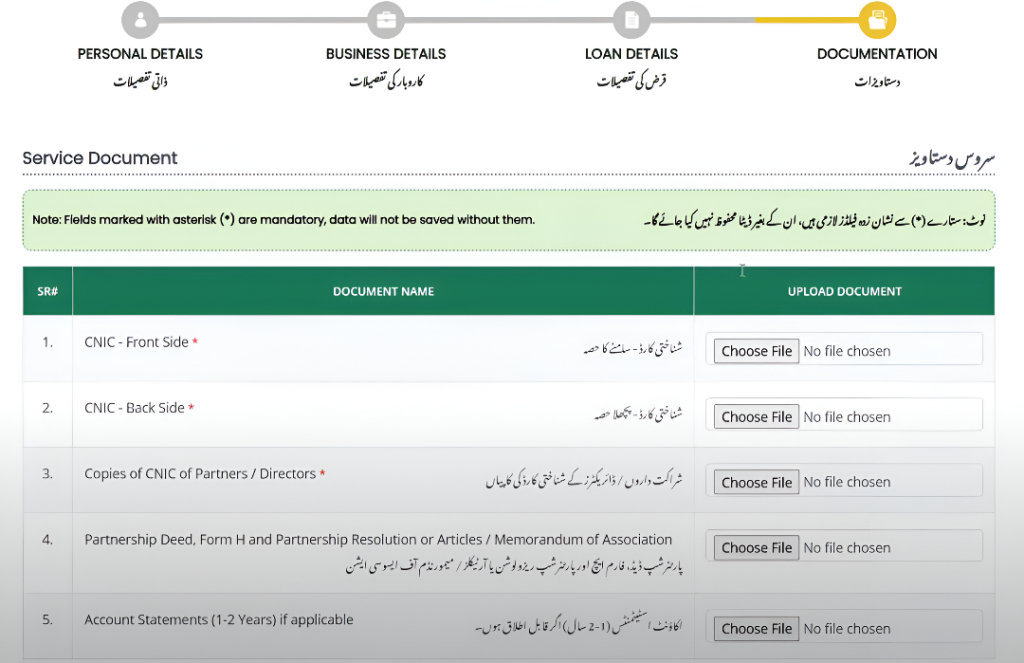

- Upload required documents (CNIC, proof of business, etc).

- Pay the non-refundable processing fee of PKR 500 using the provided PSID/challan.

Submit and Wait for Verification

- The government will check your details and business.

- If everything is correct, your application will be approved and you’ll receive your Asaan Karobar Card.

Asaan Karobar Card Loan Details

Tier-1

- Loan Amount: PKR 1–5 million

- Security: Personal Guarantee

- Tenure: Up to 5 years

- Interest Rate: 0%

- Processing Fee: PKR 5,000

- Equity Contribution: 0% (25% for leased vehicles)

Tier-2

- Loan Amount: PKR 6–30 million

- Security: Secured (Collateral)

- Tenure: Up to 5 years

- Interest Rate: 0%

- Processing Fee: PKR 10,000

- Equity Contribution: 20% (10% for special groups)

Note: Grace Period: Up to 6 months for start-ups/new businesses, up to 3 months for existing businesses.

Equity Contribution

- Tier-1 (T1): 0% (except leased commercial vehicles)

- Tier-2 (T2): 20% (all other cases)

- Special Categories (Females, Transgender, Differently-abled): 10%

Additional Costs

Handling Fee:

- NIL for new businesses

- 3% per annum for existing businesses

- NIL per annum for climate-friendly businesses (T2 only)

Other Charges: Insurance, legal, and registration charges as per actual costs

Repayment Terms

- Installments: Equal monthly installments as per approval terms

- Late Charges: PKR 1 per 1,000 per day on overdue amounts

- Revolving Credit Facility: Access and reuse funds within the first 12 months; after that, repay in 24 monthly installments

New & Noteworthy Features (2026)

- Digital Personal Guarantee: Now fully online for faster processing

- Special Priority: Reduced equity and priority for women, transgender, and differently-abled applicants

- No NOC Required: Apply without needing a No Objection Certificate

- Subsidized Land: New businesses may get land at subsidized rates (as per government policy)

- Climate-Friendly Incentive: NIL handling fee for climate-friendly businesses in T2

- Life Insurance: Included for all borrowers during the loan period

- Fully Digital Process: From application to tracking and disbursement, everything is online

- Physical Verification: Business premises will be verified within six months of approval

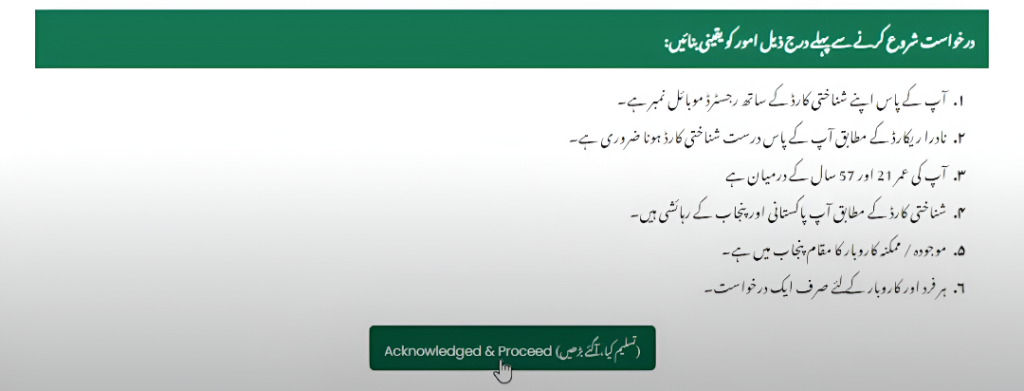

Eligibility Criteria

- Age: 21–57 years

- Pakistani national, resident of Punjab

- Valid CNIC and mobile number (registered in applicant’s name)

- Existing or new business in Punjab

- Clean credit history, no overdue loans

- Only one application per individual/business

- Satisfactory credit and psychometric assessment

- For T2: Collateral required (property/assets)

- For all: Must provide required business documents (feasibility, ownership/rent, NTN, etc.)

Usage of Funds

- Vendor and supplier payments

- Utility bills, government fees, and taxes

- Cash withdrawal (up to 25% of the limit) for business needs

- Digital transactions via POS and mobile app

How to Check Asaan Karobar Card Status

Curious about the progress of your Asaan Karobar Card application? Checking your status is simple and only takes a few minutes:

Login to Your Account

- Visit the official Asaan Karobar Card portal and log in using your CNIC and password.

Go to Application Status

- You’ll find your status displayed at the top of your dashboard.

- At the top of your dashboard, you’ll see your status. If it says “accepted,” you’re approved. If it says “rejected” or “null,” contact the helpline for help.

How to Login to Asaan Karobar Card Portal

Logging in to the Asaan Karobar Card portal is quick and straightforward. Login in easy:

- Visit the Official Website:

Open your browser and go to akc.punjab.gov.pk. - Click on “Login”:

Look for the “Login” button on the homepage and click it. - Enter Your Details:

Type your CNIC number and your password in the provided fields. - Access Your Dashboard:

After logging in, you’ll be taken to your personal dashboard. Here, you can view your loan details, check your application status, track repayments, and manage your account settings.

How to Grow Your Business Easily with the Asaan Karobar Card

Want to take your business to the next level without hassle? Here’s how you can use the Asaan Karobar Card to make business growth simple:

- Register for the Asaan Karobar Card online.

- Use the interest-free loan to meet your business needs.

- Repay the loan in easy installments.

- Grow your business confidently, without financial stress.

Benefits of the Asaan Karobar Card

- Quick Financial Support: Get easy access to funds for your business.

- No Interest Worries: Save money with 0% interest.

- Transparent Process: All transactions are digital and secure.

- Business Growth: Use funds for daily expenses or expansion.

- Inclusive: Open to all small businesses and sectors in Punjab.

- Flexible Repayment: Easy installments after a grace period.

- Government Backed: Reliable and trustworthy support.

What is the Asaan Karobar Portal?

The Asaan Karobar Portal is the official online platform for the scheme, where you can register, apply for loans, check your application status, and log in to manage your account. Designed to be user-friendly, the portal makes the entire process simple—even for those with minimal technical experience.

What is Asaan Kart?

“Asaan Kart” is another name people use for the Asaan Karobar Card. Once your application is approved, you receive this digital card, which can be used for business-related payments and expenses. It offers a convenient and secure way to manage your business finances under the scheme.

How to Check Asaan Karobar Card Status Online

To check your application status online:

Go to akc.punjab.gov.pk, log in with your CNIC and password, and check your status at the top of your dashboard. If it says “accepted,” you’re approved. If it says “rejected” or “null,” contact the helpline at 1786.

Checking your status online is fast and easy. You don’t need to visit any office. Just keep checking regularly so you can quickly fix any issues if needed.

How to Check Asaan Karobar Card Status by CNIC

To check your Asaan Karobar Card status by CNIC, log in to the official portal using your CNIC and password. Once you access your dashboard, you’ll see the most recent updates about your application and card delivery status displayed clearly at the top of the page.

What is the Role of Maryam Nawaz in Asaan Karobar Card?

Maryam Nawaz, as Chief Minister of Punjab, is the main force behind the Asaan Karobar Card and Finance Scheme. She officially launched these programs to help small business owners, young entrepreneurs, and even farmers get interest-free loans. Under her leadership, the scheme offers loans from PKR 1 million up to PKR 30 million, all with simple online applications and no complicated paperwork.

Maryam Nawaz has also announced extra support, like providing land at subsidized rates for new businesses and making the process fast and transparent. Her goal is to create more jobs, boost Punjab’s economy, and make it easier for people to start or grow their own businesses.

How to Check Old Age Pension Status in Punjab

To check your old age pension status in Punjab, go to the official Punjab Social Welfare Department website. There, you’ll find an option to check pension status. Enter your CNIC or pension number, and you’ll see the latest update about your pension application or payments.

If you face any issues or can’t find your status online, you can contact the Social Welfare Department’s helpline or visit your nearest office for help. Always keep your CNIC and application details with you for a quick check.

How to Check Your Application Status

After submitting your application, you can check your status anytime by logging in to the official portal with your CNIC and password. Once logged in, your dashboard will show the current status and any updates about your application.

If you have any questions about your status or face any difficulties, support is always available. You can contact the official helpline at 1786 for prompt assistance and guidance throughout the process.

Key Features of the Asaan Karobar Card

- Interest-Free Loans: Borrow up to PKR 1 million with 0% interest.

- Digital Payments: Pay vendors, bills, and fees through mobile apps and POS.

- Cash Withdrawal: Take out up to 25% of your loan in cash.

- Grace Period: No repayments for the first 3 months.

- Revolving Credit: Reuse funds in the first 12 months, then repay in 24 monthly installments.

- Easy Online Application: Apply digitally with minimal paperwork.

- Flexible Usage: Use funds for various business needs.

Tips for a Smooth Login Experience

- Double-Check Your Details: Always enter your CNIC and password carefully to avoid login errors.

- Use a Secure Connection: Make sure you’re using a trusted device and a secure internet connection to protect your personal information.

- Keep Your Password Safe: Never share your password with anyone. If you forget it, use the “Forgot Password” option to reset it securely.

- Update Your Browser: For the best performance, use the latest version of your web browser.

- Clear Cache and Cookies: If you face any issues, try clearing your browser’s cache and cookies before logging in again.

- Contact Support if Needed: If you experience repeated problems, don’t hesitate to call the helpline at 1786 for prompt assistance.

Asaan Karobar Card Helpline Number

The support team is available to help you with registration, status checks, and any other concerns related to the scheme.

- Helpline Number: 1786

- Services: Assistance with registration, eligibility, and the application process

- Working Hours: Available during standard office hours

Frequently Asked Questions

What documents are required for the Asaan Karobar Card Application?

You’ll need your CNIC, a recent passport-size photo, business documents (like registration or a rent agreement), and references.

How can I check the status of my Asaan Karobar Card Application?

Log in to the portal using your CNIC and password. Your application status will be displayed on your dashboard.

What is the Maximum loan Amount Available through the Asaan Karobar Card?

You can get an interest-free loan of up to PKR 1 million for your business needs.

Is the Asaan Karobar Card Available for Women Entrepreneurs?

Yes, women, as well as transgender and differently-abled persons, are encouraged to apply and may benefit from reduced equity requirements.

Can I withdraw cash using the Asaan Karobar Card?

Yes, you can withdraw up to 25% of your approved loan amount in cash for business purposes.

What is the grace Period for loan Repayment?

There is a 3-month grace period from the date of card issuance before you need to start repayments.

Who launched the Asaan Karobar Card Scheme?

The scheme was launched by the Government of Punjab under the leadership of Chief Minister Maryam Nawaz.

Is there any interest charged on the Asaan Karobar Card loan?

No, the loan is completely interest-free (0% markup).

What should I do if I face Issues During Registration or login?

You can call the official helpline at 1786 for assistance with registration, eligibility, or any technical problems.

Conclusion

The Asaan Karobar Card offers an excellent opportunity for small business owners and entrepreneurs in Punjab to access interest-free loans and grow their businesses with ease. The application process is straightforward, and all key steps can be managed through the official online portal.

Remember to keep your login details secure and regularly check your dashboard for updates. If you need any assistance or have questions, the helpline at 1786 is always available to support you.