ATM Card Now Being Delivered: Asaan Karobar Card Scheme Latest Update

Hey there! If you’ve been waiting for your Asaan Karobar Card ATM card, good news—it’s finally happening! Cards are now being delivered to registered applicants across Punjab. Whether you’re new to this or just want to know what’s next, this guide’s got you covered—no jargon, just clear info.

Asaan Karobar Card Scheme: What’s New in 2025?

The Asaan Karobar Card Scheme is Punjab’s big move to help small business owners. You get up to 10 lakh PKR as an interest-free loan. That’s a lot of support! The scheme is online and simple, so you don’t have to run around offices anymore.

Now, the latest update is that ATM cards are being delivered to those who registered in early 2025. If you applied, keep your phone close—the bank will call you soon. After the call, expect your card in about a week.

ATM Card Delivery Update: What to Expect

If you’ve applied for the Asaan Karobar Card, here’s what’s happening right now. Banks are reaching out to confirm your details. Once they do, your ATM card is on its way. Delivery usually takes about a week after the bank’s call. Sometimes, it’s faster; sometimes, it’s a bit slow—depends on your area.

Make sure your phone is on and you answer the call. If you miss it, your card might be delayed. And don’t worry—the bank won’t ask for your PIN or password, so stay alert for scams.

Asaan Karobar ATM Cards: How They Work

The Asaan Karobar ATM card is your key to the loan money. You can use it to withdraw cash, pay bills, or shop online. It’s like any other bank card but with extra benefits for business owners. The card is linked to your Asaan Karobar account, so all your loan funds are safe and easy to access.

Activation is simple. Most banks let you activate your card by phone or at an ATM. Just follow the instructions that come with the card. If you’re not sure, call your bank’s helpline—they’re there to help.

ATM Card Scheme Pakistan: Who Can Apply?

You need to be between 25 and 55 years old, a registered taxpayer, and have a clean credit history. You’ll also need a valid CNIC and NTN, plus proof of your business premises. Don’t have all that? No worries—just check the official portal for a full list of requirements.

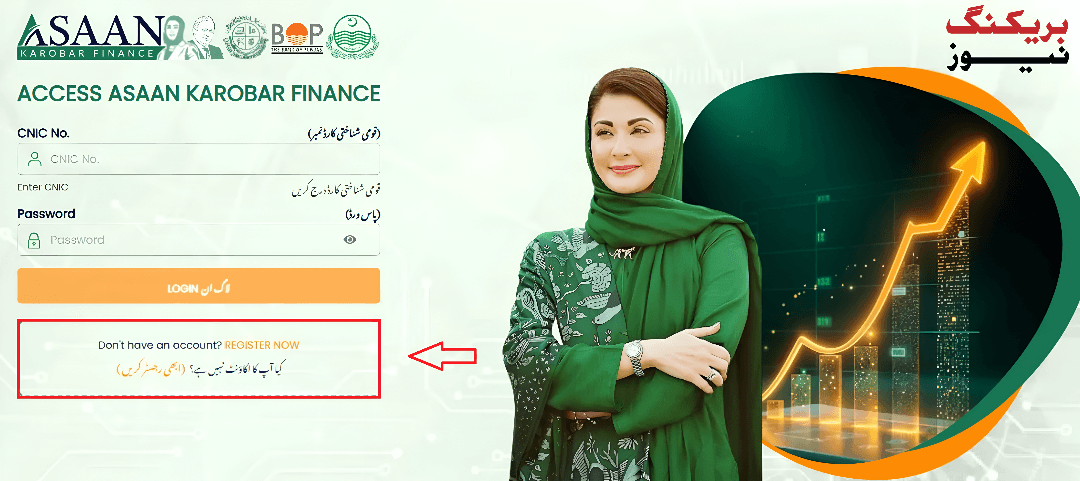

The process is online, so you can apply from home. Just visit the Asaan Karobar Card website or call the helpline. It’s quick and easy, and you’ll get updates every step of the way.

Latest Asaan Karobar Card Update: What’s Changed?

The biggest change in 2025 is the delivery of ATM cards. The government is making sure everyone gets their card on time. They’ve also made the process simpler, so you don’t have to wait for months. If you applied early, your card is probably already on its way.

Another update is the number of applicants. Over 80,000 people have been approved, and more than 34,000 have already received their loans. That’s a lot of happy business owners!

How Long Does It Take? ATM Cards Delivery Pakistan

For most people, it takes about a week to get the ATM card after the bank calls. Sometimes, it’s a bit longer if you live in a remote area. But usually, you won’t have to wait too long. Just keep an eye on your phone and check your application status online if you’re unsure.

If you’re using Easypaisa or JazzCash, delivery might take a bit longer—usually 7 to 14 days. But for most banks like NBP, Askari, UBL, and HBL, it’s faster.

ATM Cards Scheme 2025: Which Banks Are Involved?

The Asaan Karobar Card works with several banks and fintech companies. These include Askari Bank, NBP, Easypaisa, JazzCash, UBL, and HBL. Each bank has its own way of delivering and activating cards, but the process is pretty much the same.

If you have a preference, you can choose your bank when you apply. Otherwise, the system will assign one for you.

Asaan Karobar Card Delivery: What to Do If You Haven’t Received Yours

If it’s been more than a week since the bank called and you still don’t have your card, don’t panic. Check your application status online. If it says “delivered” but you haven’t got it, contact your bank right away.

Sometimes, cards get lost in the mail or there’s a delay at the post office. The bank can help you track it or issue a new one if needed.

ATM Card Scheme Details: Common Issues and Solutions

Here are some common problems people face with their ATM cards and how to solve them:

Karobar Card Latest Information: Tips for Smooth Delivery

Want to get your card fast? Here are some tips:

Askari Bank Card Activation: How It Works

If your Asaan Karobar Card is from Askari Bank, activation is easy. You can do it by phone or at any Askari ATM. Just follow the instructions that come with your card. If you’re stuck, call the helpline—they’re friendly and helpful.

Easypaisa ATM Card Order: What You Need to Know

If you’re getting your card through Easypaisa, you can order it online. Delivery usually takes 7 to 14 days. Once you get it, follow the activation steps in the app or on the website.

Easypaisa cards have a daily withdrawal limit, usually up to 50,000 PKR. That’s more than enough for most business needs.

Easypaisa Debit Card Delivery Time

For Easypaisa, expect your card in 7 to 14 days after you order it. Sometimes, it’s faster if you live in a big city. If it’s taking longer, check your order status in the app or call customer service.

NBP ATM Card Delivery Time

If your card is from NBP, you’ll usually get it within a week after the bank calls. You can check your card status online or by calling the bank.

Easypaisa Visa Debit Card Order Online

Ordering an Easypaisa Visa debit card is simple. Just log in to your Easypaisa account, go to the cards section, and follow the steps. You’ll get your card in the mail, and you can track its status online.

NBP ATM Card Status Check Online

To check your NBP ATM card status, visit the NBP website or call their helpline. You’ll need your application number or CNIC to check. It’s quick and easy, so you always know where your card is.

Jazz Cash Visa Debit Card Order Fees

JazzCash offers Mastercard debit cards with a small fee for ordering. Delivery usually takes 10 to 15 days. You can order it online or through the JazzCash app.

JazzCash Mastercard Debit Card

With JazzCash, you get a Mastercard debit card that works worldwide. Ordering is easy, and delivery is usually within 10 to 15 days. You can use it for online shopping, travel, and more.

Easypaisa Debit Card Withdrawal Limit

Easypaisa cards have a daily withdrawal limit, usually up to 50,000 PKR. That’s plenty for most small businesses. If you need more, check with Easypaisa for special arrangements.

Sometimes, ATMs are down or not working. If you see a message like “ATM not working today Pakistan,” try another ATM or check back later. It’s usually a temporary issue.

ATM Transaction Not Allowed

If you get a message saying “ATM transaction not allowed,” make sure your card is activated and you have enough balance. If the problem continues, contact your bank.

Dear Customer Your ATM Card Has Been Blocked

If your card is blocked, it’s usually because you entered the wrong PIN too many times. Call your bank to unblock it. Don’t worry—it happens to everyone now and then.

If your card’s chip isn’t readable, try cleaning it with a soft cloth. If it still doesn’t work, ask your bank for a replacement. It’s a common issue and easy to fix.

ATM Not Working Today Pakistan 2022

This message is old, but sometimes ATMs still have issues. If you see it, try another ATM or check with your bank. Most problems are fixed quickly.

UBL ATM Card Not Received

If you haven’t received your UBL ATM card, check your status online or call UBL customer service. They can help you track it or issue a new one if needed.

HBL ATM Card Not Received

Same goes for HBL—if your card hasn’t arrived, check your status online or call HBL. They’re usually quick to help.

ATM Card Captured

If your card is captured by the ATM, don’t panic. Call your bank right away. They’ll help you get it back or issue a new one if needed.

Tips and Tricks

FAQs

How long does it take to receive the Asaan Karobar ATM card after approval?

ATM cards are usually delivered within one week after the bank confirms your details via phone call.

What should I do if my Asaan Karobar ATM card is not working?

If your card is not working, contact your bank immediately. Common issues include blocked cards or chip problems.

Can I activate my Asaan Karobar ATM card online?

Activation methods vary by bank. Some banks allow phone or ATM activation, but online activation is not always available.

What happens if I lose my Asaan Karobar ATM card?

Report the loss immediately to your bank to block the card and apply for a replacement to avoid unauthorized transactions.

Conclusion

The Asaan Karobar Card Scheme is making life easier for small business owners in Punjab. With ATM cards now being delivered, accessing your loan is simpler than ever. Just keep your phone on, check your status online, and contact your bank if you have any issues. Happy business building!