Asaan Karobar 2026 Apply Online for Business Loans Up to 3 Crores

The Asaan Karobar 2026 scheme is a game-changer for small and medium-sized businesses. Through this initiative, the CM Punjab loan scheme 2026 offers an incredible opportunity for businesses to access loans of up to 3 crores without facing the complex processes that usually come with business loans.

Loan Calculator

Calculation Results

- Tier 1: PKR 100,000 - 5,000,000 (Processing Fee: PKR 5,000)

- Tier 2: PKR 5,000,000 - 30,000,000 (Processing Fee: PKR 10,000)

- Interest Rate: Competitive rates as per SBP guidelines

- Repayment: Flexible monthly installments

📱 1786 (Toll Free)

🕒 9:00 AM - 5:00 PM

📍 Punjab Small Industries Corporation

Lahore, Punjab

What is the maximum loan amount?

What documents are required?

How long does the approval process take?

Personal Documents:

- CNIC (Front & Back)

- Passport Size Photo

- Income Certificate

- Bank Statements (6 months)

Business Documents:

- Business Registration

- Trade License

- Tax Returns (2 years)

- Business Plan

- How to Check Your Asaan Karobar Finance Application Status

- Govt of Punjab Announces Latest Rescue 1122 Jobs 2026—Apply Online

- 3737 Ramzan Package 2026 | 9999 & 8070 Online Registration

- Ramzan Package 2026—8171 BISP 14500 & 9999 Online Registration

- Asaan Karobar 2026 Apply Online for Business Loans Up to 3 Crores

- PSER Survey Online Registration for Ramzan Package & Free Atta Rashan 2026

- ASA Pakistan Microfinance | Fast Credit Approval | Loan Application 2026

- Ramzan Package 2026 – Eid Ul Fitr Program 25000 Online Application

- Apply for CM Punjab Asaan Karobar Card Loan & Maryam Nawaz Loan Scheme 2026

- Nigehban Ramzan Package 2026 – 9999 PM Relief 13000 Check

- Apply Now for Ramzan Business Loan Package of Up to 5 Crore!

- Parwaz Card Registration Portal Online Apply Official Website

- Prime Minister Ramzan Package 2026 – Rs. 13,000 Online Check & Apply

- Punjab Asaan Karobar Phase 2—Rs90bn Interest-Free Loans for Small Businesses

- How to Apply for the CM Punjab Loan Scheme 2026 | Asaan Karobar Scheme Online Application Guide

- How to Apply for Maryam Nawaz Livestock Card 2026 | Free Janwar Loan 2000 Dollars Online Application

This guide will walk you through everything you need to know about the Asaan Karobar online application process, how to check your loan application status, and much more.

What Is the Asaan Karobar Scheme?

The Asaan Karobar scheme is a financial initiative launched by the Punjab Government to support small and medium businesses. The goal of this scheme is to provide easy access to business loans to individuals who wish to start or expand their business. This initiative aims to strengthen the local economy and create job opportunities by making business financing more accessible.

Why Choose Asaan Karobar 2026?

The Asaan Karobar 2026 scheme offers multiple benefits for business owners, including:

- Loan Amount: Up to 3 crores.

- Lower Interest Rates: The loans are offered at very affordable rates.

- Simple Application Process: The entire application process is online, eliminating the need for paperwork and reducing the hassle of traditional loan applications.

- Quick Approval: The processing time is much faster compared to traditional loans, allowing businesses to access funds quickly.

This scheme is designed to provide entrepreneurs with the tools and support they need to thrive in Pakistan’s competitive market.

CM Punjab Asaan Karobar Loan Scheme 2026 – Online Apply

The CM Punjab Asaan Karobar loan scheme 2025 is specifically designed to help small and medium-sized businesses. If you are an eligible entrepreneur, you can apply for loans online through the official portal.

Eligibility Criteria for Asaan Karobar Scheme

To apply for the Asaan Karobar Finance Scheme, you must meet the following criteria:

- Pakistani Citizenship: Applicants must be Pakistani nationals.

- Business Experience: You should have experience running a business or be able to show a viable business plan.

- Proper Documentation: You must provide documents such as your CNIC, business registration, and proof of income.

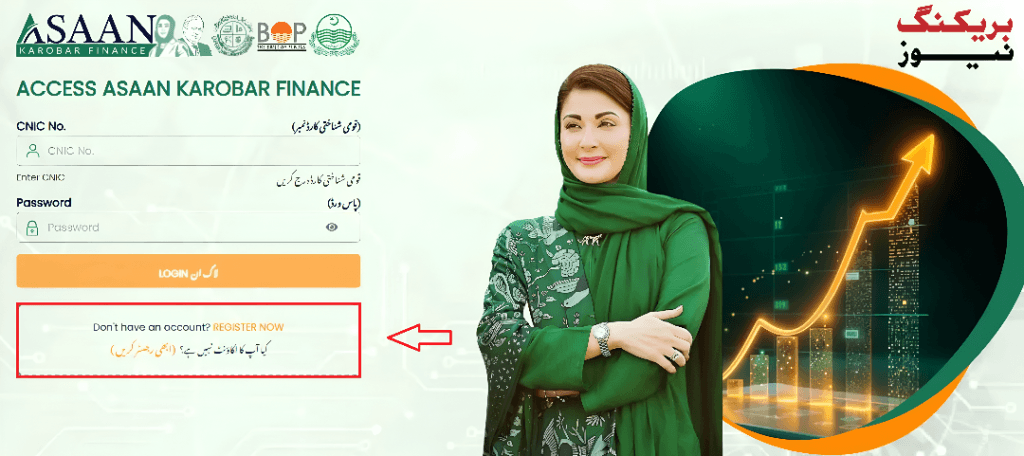

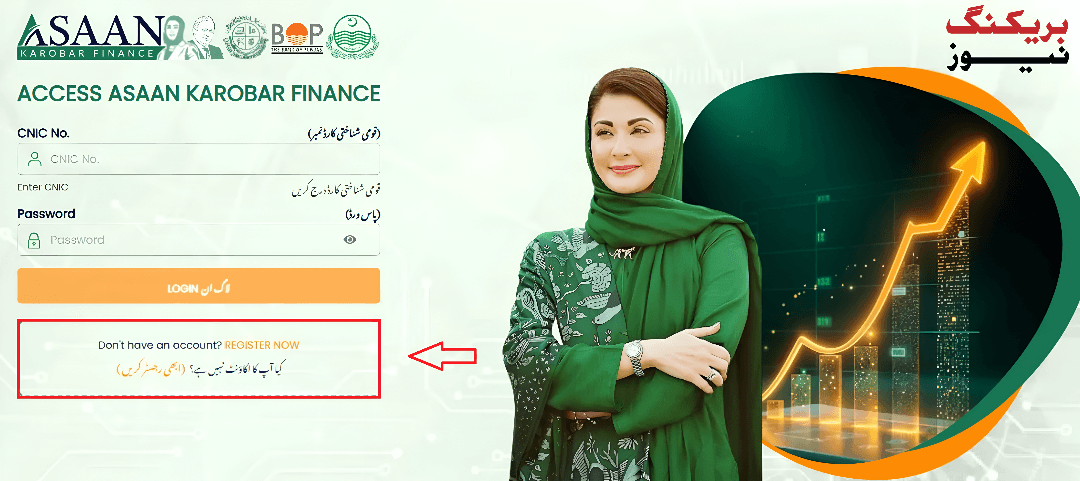

How to Apply for Asaan Karobar Scheme Online?

Applying for the Asaan Karobar Scheme 2026 is simple and straightforward. Here’s a step-by-step guide:

- Visit the Official Portal: Go to the Asaan Karobar official website or portal.

- Create an Account: If you haven’t registered yet, create an account by entering your basic details like CNIC, mobile number, and email address.

- Fill Out the Application Form: Once logged in, fill out the application form. You will need to provide details about your business, including the type, size, and financial needs.

- Upload Documents: Upload all required documents, including your business registration and proof of income.

- Submit Your Application: After completing the form and uploading documents, submit your application.

- Wait for Approval: Your application will be processed, and you will receive updates regarding the approval status.

Asaan Karobar Finance Login – Access Your Account

Once you’ve registered for the Asaan Karobar finance scheme, you can log in to your account at any time to track your loan status, check documents, and apply for any updates or additional support. The login portal allows you to:

- View loan status.

- Track the approval process.

- Update your business information.

Asaan Karobar Apply Online – Easy Process

The Asaan Karobar apply online process is extremely user-friendly, designed to be accessible for everyone, including those who may not be familiar with technology. The platform is intuitive and provides easy navigation for applicants. With just a few clicks, you can access and complete the entire loan application process.

Why is Online Application Important?

Applying online offers several advantages:

- Time-Saving: No need to visit offices or stand in long queues.

- Convenience: Apply from anywhere at any time.

- Faster Approval: Online applications are processed faster than paper-based applications.

Asaan Karobar Finance Scheme 2026 – Key Features

The Asaan Karobar Finance Scheme 2026 is designed to offer:

- Flexible Repayment Terms: Loans are provided with flexible repayment options, making it easier for business owners to manage their finances.

- Business Support: In addition to financial assistance, the program also offers business advisory services to ensure success.

- Affordable Interest Rates: Competitive interest rates make the scheme accessible for small business owners.

This scheme is tailored to suit the needs of small businesses, with a focus on creating a friendly environment for growth.

How to Check Your Status on the Asaan Karobar Card

The Asaan Karobar card is a valuable part of the scheme, providing easy access to your loan and other benefits. Once you apply and are approved for the scheme, you will receive an Asaan Karobar card. To check your Asaan Karobar card status, follow these steps:

- Log in to your account on the official website.

- Navigate to the status section and check the progress of your application.

- Once approved, the card will be issued, and you can use it for business transactions.

CM Punjab Loan Scheme 2025 Online Apply

The CM Punjab Loan Scheme 2025 is another important financial initiative that aims to provide loans to businesses in Punjab. This scheme is designed for small businesses and entrepreneurs who need financial support to grow their ventures. The application process is similar to Asaan Karobar: it’s online, easy, and accessible.

Features of CM Punjab Loan Scheme:

- Loan Amount: Varies depending on the size of the business and its needs.

- Quick Process: Approval is faster compared to traditional loans.

- Loan for Various Sectors: This scheme supports businesses in various sectors, including retail, manufacturing, and services.

Asaan Karobar Card Login – Access Your Loan Details

Once your Asaan Karobar Card is issued, you can easily log in to your account using your card credentials to:

- View loan details.

- Make repayments.

- Track loan status.

This login process is secure, ensuring your business details remain confidential.

Asaan Karobar 2026 Online Application—Everything You Need to Know

Asaan Karobar 2026 is a valuable initiative that helps entrepreneurs gain easy access to loans for growing their businesses. The process is simple, the requirements are clear, and the benefits are immense. Whether you’re a small business owner or a startup, this scheme can provide the financial support you need to take your business to the next level.

FAQs

How long does it take to get approval for a loan under Asaan Karobar?

The loan approval process is quick, usually taking a few days to a week, depending on the application and documentation.

What documents are required to apply for Asaan Karobar?

You will need your CNIC, business registration, proof of income, and other relevant business documents.

Can I apply for the loan online?

Yes, the Asaan Karobar loan application process is fully online.

Can I check my Asaan Karobar loan status online?

Yes, you can log in to your account and check the status of your application and loan approval.

Is the loan interest rate affordable under Asaan Karobar?

Yes, the interest rates under the Asaan Karobar scheme are competitive and affordable for small business owners.

What is the Asaan Karobar card?

The Asaan Karobar card is issued to approved applicants, providing easy access to your loan and related services.

Conclusion

The Asaan Karobar 2026 scheme is a significant step toward supporting small and medium-sized businesses in Pakistan. With easy online application, affordable interest rates, and flexible terms, it’s a great opportunity for entrepreneurs to access funds. If you are eligible, don’t miss out on this chance to grow your business and make a positive impact on Pakistan’s economy.