How to Apply for Asaan Karobar 2026 Online | Business Loan 3 Crore | Maryam Nawaz Qarza

Are you an entrepreneur or small business owner in Pakistan looking for financial support? Punjab’s Asaan Karobar 2026 scheme offers start-ups and small businesses an excellent opportunity. A loan of up to 3 crore rupees is possible through this program.

Loan Calculator

Calculation Results

- Tier 1: PKR 100,000 - 5,000,000 (Processing Fee: PKR 5,000)

- Tier 2: PKR 5,000,000 - 30,000,000 (Processing Fee: PKR 10,000)

- Interest Rate: Competitive rates as per SBP guidelines

- Repayment: Flexible monthly installments

📱 1786 (Toll Free)

🕒 9:00 AM - 5:00 PM

📍 Punjab Small Industries Corporation

Lahore, Punjab

What is the maximum loan amount?

What documents are required?

How long does the approval process take?

Personal Documents:

- CNIC (Front & Back)

- Passport Size Photo

- Income Certificate

- Bank Statements (6 months)

Business Documents:

- Business Registration

- Trade License

- Tax Returns (2 years)

- Business Plan

Asaan Karobar’s Finance Scheme will be explored in detail in this guide. Additionally, we will discuss the Maryam Nawaz Qarza as well as the benefits of applying online.

- How to Check Your Asaan Karobar Finance Application Status

- Govt of Punjab Announces Latest Rescue 1122 Jobs 2026—Apply Online

- 3737 Ramzan Package 2026 | 9999 & 8070 Online Registration

- Ramzan Package 2026—8171 BISP 14500 & 9999 Online Registration

- Asaan Karobar 2026 Apply Online for Business Loans Up to 3 Crores

- PSER Survey Online Registration for Ramzan Package & Free Atta Rashan 2026

- ASA Pakistan Microfinance | Fast Credit Approval | Loan Application 2026

- Ramzan Package 2026 – Eid Ul Fitr Program 25000 Online Application

- Apply for CM Punjab Asaan Karobar Card Loan & Maryam Nawaz Loan Scheme 2026

- Nigehban Ramzan Package 2026 – 9999 PM Relief 13000 Check

- Apply Now for Ramzan Business Loan Package of Up to 5 Crore!

- Parwaz Card Registration Portal Online Apply Official Website

- Prime Minister Ramzan Package 2026 – Rs. 13,000 Online Check & Apply

- Punjab Asaan Karobar Phase 2—Rs90bn Interest-Free Loans for Small Businesses

- How to Apply for the CM Punjab Loan Scheme 2026 | Asaan Karobar Scheme Online Application Guide

- How to Apply for Maryam Nawaz Livestock Card 2026 | Free Janwar Loan 2000 Dollars Online Application

What is Asaan Karobar 2026?

The Asaan Karobar 2026 program is a government initiative aimed at empowering entrepreneurs and business owners in Pakistan. Financial support is available to those who have a business idea but lack the capital to launch or expand their business. This program offers a variety of loans for businesses looking to grow or startups looking to expand.

CM Punjab Asaan Karobar Loan Scheme 2026

The CM Punjab Asaan Karobar Loan Scheme offers loans with low-interest rates and easy repayment terms. Small businesses in Punjab can get the funding they need through the program. Sardar Usman Buzdar, Punjab’s chief minister, launched this initiative to support the local economy.

Key Features of CM Punjab Asaan Karobar Loan Scheme:

- Loans of up to 3 crore rupees.

- Low interest rates.

- Flexible repayment options.

- No need for heavy documentation.

- Quick approval process.

- Priority to women entrepreneurs.

By providing access to these loans, the Punjab government aims to boost local businesses, encourage entrepreneurship, and stimulate economic growth in the region.

How to Apply for Asaan Karobar 2026 Online?

Now that you know the benefits, you might wonder how to apply for the Asaan Karobar Finance Scheme 2026. The process is relatively simple and can be done online.

Application Guide for Asaan Karobar 2026:

- Visit the Official Website: Go to the official Asaan Karobar website. The application portal is user-friendly and easy to navigate.

- Create an Account: First, you’ll need to create an account by entering your personal details, such as your name, contact information, and business information.

- Fill in the Application Form: After logging in, fill out the application form. You will need to provide detailed information about your business, such as:

- Type of business

- Business model

- Expected funding requirement

- Financial statements (if available)

- Upload Required Documents: Attach the necessary documents. These usually include:

- National Identity Card (CNIC)

- Business registration documents

- Bank statements (if applicable)

- Proof of address

- Submit the Application: Once you’ve filled out the form and uploaded the documents, submit your application.

- Wait for Approval: The Punjab government’s team will review your application. If everything is in order, your loan will be approved, and you’ll be notified of the loan amount and repayment details.

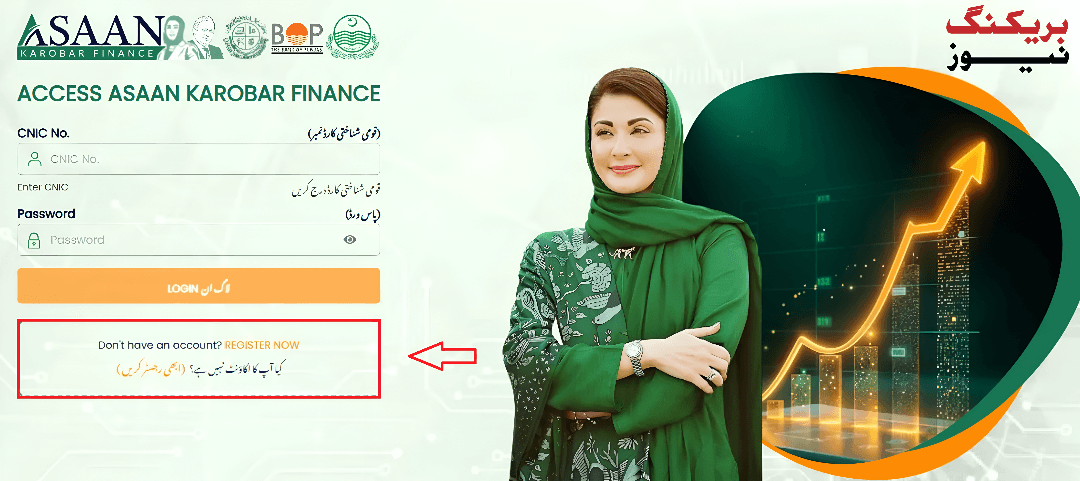

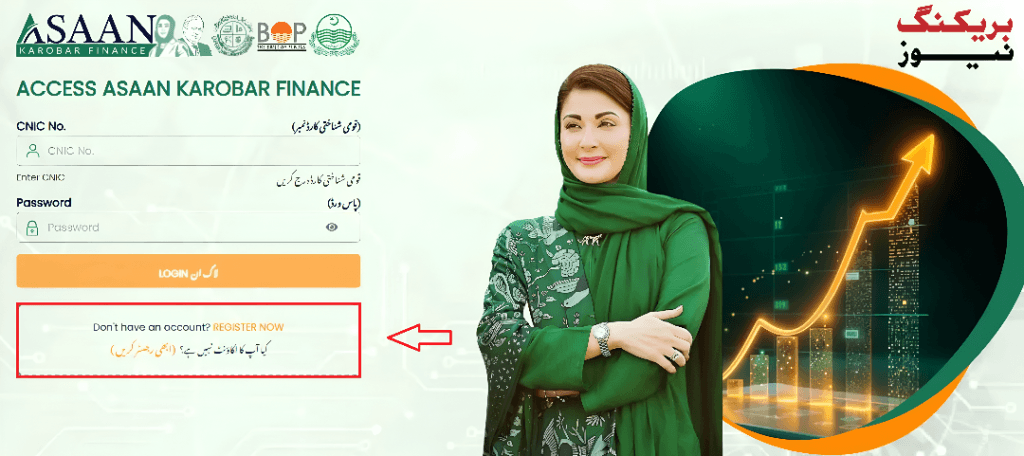

Asaan Karobar Finance Login and Status Check

After applying for the Asaan Karobar Loan, you can easily track your application status and log in to the portal for updates.

How to Log in to the Asaan Karobar Finance Portal:

- Visit the Asaan Karobar website.

- Click on the “Login” button.

- Enter your registered email and password.

- Access your application dashboard, where you can check your application status and loan approval details.

How to Check Your Asaan Karobar Application Status:

- Go to the Application Status Check section on the website.

- Enter your application ID or CNIC.

- You will be able to see the status of your loan application, whether it’s pending, approved, or rejected.

What is Maryam Nawaz Qarza?

Maryam Nawaz Qarza is another financial support program introduced by Maryam Nawaz, focused on offering interest-free loans to women entrepreneurs. The loans are designed to help women start or expand their businesses, particularly in rural Punjab areas. The goal is to empower women by providing them with the financial resources they need to succeed.

Key Features of Maryam Nawaz Qarza:

- Interest-free loans.

- Priority will be given to women in rural areas.

- Loans for business expansion or startup.

- Quick disbursement and simple documentation.

Women can apply for the Maryam Nawaz Qarza through the same online portal used for the Asaan Karobar scheme. This is an excellent opportunity for women entrepreneurs to gain financial independence and contribute to the economy.

Benefits of Asaan Karobar 2026 Finance Scheme

The Asaan Karobar 2026 scheme is not just about securing a loan—it’s about fostering entrepreneurship and boosting local businesses. Some key benefits of the program include

- Easy Access to Finance: Unlike traditional loans that require paperwork and collateral, the Asaan Karobar scheme offers a streamlined application process with minimal documentation.

- Low-Interest Rates: The interest rates are affordable, which makes it easier for business owners to pay back the loan over time.

- Flexible Loan Amounts: The loan amount can vary based on the size and nature of the business, ranging from small loans for startups to larger amounts for established businesses.

- Support for Women: The scheme prioritizes women entrepreneurs, helping them achieve business success and financial independence.

Tips for a successful application

Applying for a loan through the Asaan Karobar 2026 scheme can be a game-changer for your business, but it’s important to ensure your application stands out. Here are some tips to improve your chances of approval.

- Prepare a Solid Business Plan: A well-thought-out business plan shows that you are serious about your business and can help you repay the loan.

- Ensure Accurate Documentation: Double-check your documents before submission to avoid delays.

- Show Your Business’ Potential: Highlight any past achievements or projections that show your business is poised for growth.

- Apply Early: Don’t wait until the last minute to apply—start the process as soon as possible to avoid missing out.

Frequently Asked Questions

- What is the Asaan Karobar Loan Scheme?

- The Asaan Karobar Loan Scheme is a government initiative to provide loans to small business owners in Punjab. It offers loans of up to 3 crore rupees with easy repayment options.

- How can I apply for the Asaan Karobar Finance Scheme online?

- You can apply through the official website by creating an account, filling out an application form, and submitting the required documents.

- Is there a loan specifically designed for women entrepreneurs?

- Yes, Maryam Nawaz Sharif offers interest-free loans to women entrepreneurs, especially in rural areas.

- What is the loan amount available under the CM Punjab Asaan Karobar scheme?

- Loans up to 3 crore rupees are available, depending on your business size and requirements.

- How can I check my Asaan Karobar loan application status?

- You can check the status of your application by logging into the official portal using your application ID or CNIC.

- Can I apply for the loan without business registration?

- Business registration is often required, but check the official portal for more specific details about your case.

- Are there any hidden costs in the Asaan Karobar scheme?

- The program offers low-interest rates, but there might be minimal processing fees. Make sure to read the terms and conditions carefully.

Conclusion

The Asaan Karobar 2026 loan scheme is a fantastic opportunity for small business owners and entrepreneurs in Punjab to access the capital they need. Start a new business or expand your existing one with low-interest rates and minimal paperwork with this scheme. Maryam Nawaz Qarza gives women entrepreneurs added support as well. The time has come to invest in your business if you’ve been dreaming of expanding!