Apply Online for a 1500000 Loan at Maryam Nawaz Loan Scheme (Ghar Scheme) 2026

Are you looking for financial assistance in Pakistan? If you’re interested in getting a 1500000 loan for business, buying a house, or starting a new venture, you’ve come to the right place. Pakistan offers various government schemes, including the Maryam Nawaz Loan Scheme and the Apna Ghar Scheme, that can make your dreams a reality.

Loan Calculator

Calculation Results

- Tier 1: PKR 100,000 - 5,000,000 (Processing Fee: PKR 5,000)

- Tier 2: PKR 5,000,000 - 30,000,000 (Processing Fee: PKR 10,000)

- Interest Rate: Competitive rates as per SBP guidelines

- Repayment: Flexible monthly installments

📱 1786 (Toll Free)

🕒 9:00 AM - 5:00 PM

📍 Punjab Small Industries Corporation

Lahore, Punjab

What is the maximum loan amount?

What documents are required?

How long does the approval process take?

Personal Documents:

- CNIC (Front & Back)

- Passport Size Photo

- Income Certificate

- Bank Statements (6 months)

Business Documents:

- Business Registration

- Trade License

- Tax Returns (2 years)

- Business Plan

Let’s dive into these exciting opportunities and how you can apply for them in 2026!

- How to Check Your Asaan Karobar Finance Application Status

- Govt of Punjab Announces Latest Rescue 1122 Jobs 2026—Apply Online

- 3737 Ramzan Package 2026 | 9999 & 8070 Online Registration

- Ramzan Package 2026—8171 BISP 14500 & 9999 Online Registration

- Asaan Karobar 2026 Apply Online for Business Loans Up to 3 Crores

- PSER Survey Online Registration for Ramzan Package & Free Atta Rashan 2026

- ASA Pakistan Microfinance | Fast Credit Approval | Loan Application 2026

- Ramzan Package 2026 – Eid Ul Fitr Program 25000 Online Application

- Apply for CM Punjab Asaan Karobar Card Loan & Maryam Nawaz Loan Scheme 2026

- Nigehban Ramzan Package 2026 – 9999 PM Relief 13000 Check

- Apply Now for Ramzan Business Loan Package of Up to 5 Crore!

- Parwaz Card Registration Portal Online Apply Official Website

- Prime Minister Ramzan Package 2026 – Rs. 13,000 Online Check & Apply

- Punjab Asaan Karobar Phase 2—Rs90bn Interest-Free Loans for Small Businesses

- How to Apply for the CM Punjab Loan Scheme 2026 | Asaan Karobar Scheme Online Application Guide

- How to Apply for Maryam Nawaz Livestock Card 2026 | Free Janwar Loan 2000 Dollars Online Application

What is the Maryam Nawaz Loan Scheme?

The Maryam Nawaz Loan Scheme is one of the most talked-about government initiatives aimed at supporting young entrepreneurs and families. The goal is simple: help people access easy loans to fulfill their housing and business needs. Whether you’re looking to buy a house or start a small business, this scheme can provide you with the necessary financial support.

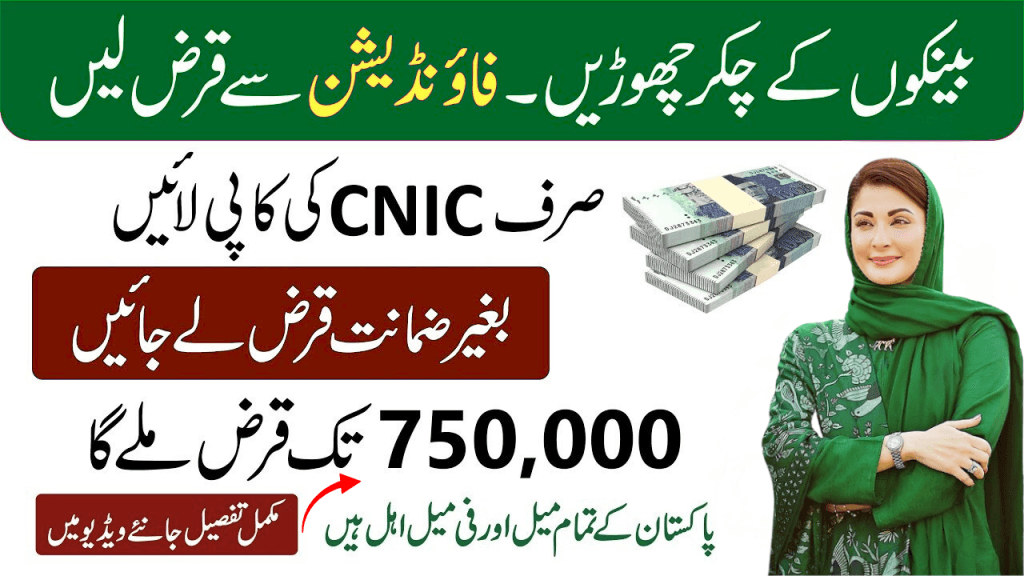

Maryam Nawaz Loan Scheme 150000

The 1500000 loan is available under the Maryam Nawaz Loan Scheme, and it’s designed to help low-income families and small businesses get a strong start. The government offers interest-free loans for both housing and business projects, ensuring that the financial burden remains manageable.

The loan is ideal for:

- Buying a house

- Starting or expanding a business

- Supporting small businesses with low-interest financing

Maryam Nawaz 15 Lakh Loan Scheme Online Apply

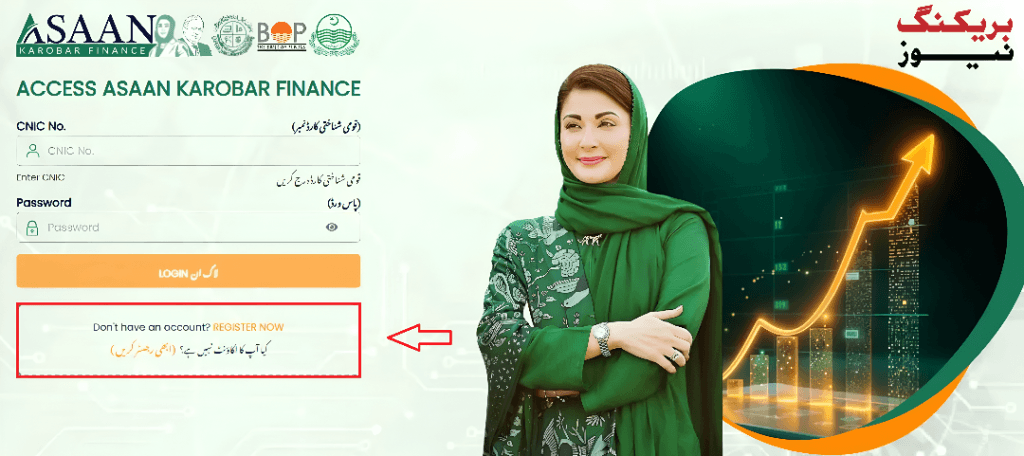

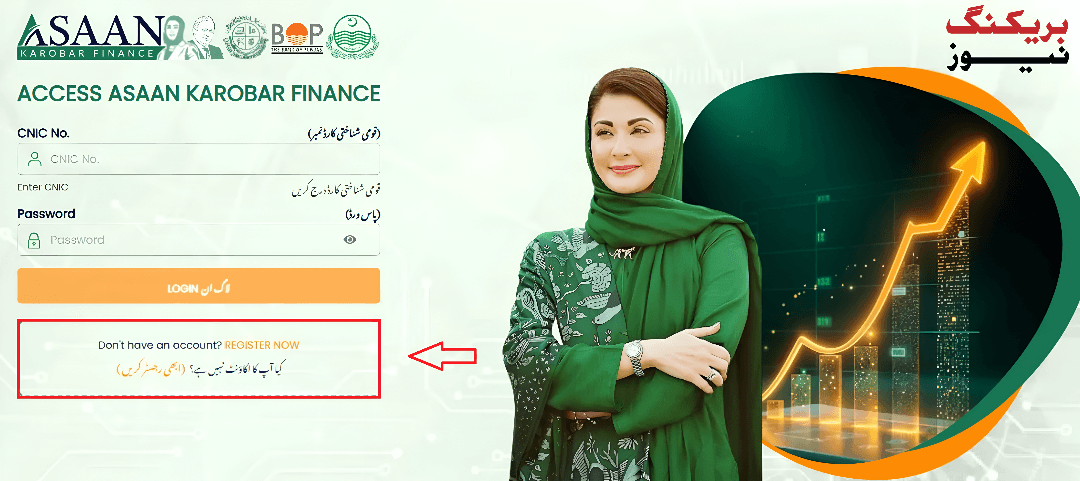

If you’re wondering how to apply for the 15 lakh loan, the process is fairly straightforward. Thanks to modern technology, the loan application can be completed online through the official portal. It’s designed to be user-friendly, making it easy for everyone to apply, even those with limited tech experience.

Maryam Nawaz Loan Scheme for House Apply Online

This part of the scheme allows you to apply for a home loan online. If you’re tired of renting and wish to own a home, this is the perfect opportunity for you. Here’s how you can go about applying for a home loan:

- Visit the Official Portal: Go to the government’s official housing loan website.

- Fill in the Application Form: Complete the form with all required details.

- Submit Supporting Documents: You’ll need to upload documents like your CNIC, proof of income, and other relevant paperwork.

- Wait for Approval: After submission, the authorities will process your application and let you know if you qualify for the loan.

The good news is that the Maryam Nawaz housing scheme offers low interest rates and flexible repayment plans, making it easier for people from all walks of life to own their homes.

Maryam Nawaz Housing Scheme 2026

In 2026, the Maryam Nawaz Housing Scheme is expected to continue supporting Pakistan’s middle-class families by providing affordable housing loans. The scheme has already assisted thousands of families, and the government aims to expand its reach in the coming years.

Apna Ghar Scheme Online Registration 2026

Another popular government initiative is the Apna Ghar Scheme, which focuses on making homeownership a reality for Pakistanis. The Apna Ghar Scheme Online Registration for 2026 will be similar to previous years but will include new features to make the application process even easier.

Apna Ghar Scheme Online Registration Form

The Apna Ghar Scheme is a government-backed housing loan program that aims to help people buy their own homes, whether they’re first-time buyers or looking to upgrade their current living situation. Here’s how you can register:

- Visit the Official Website: Head to the official Apna Ghar registration portal.

- Fill Out the Registration Form: Provide necessary details such as personal information, contact details, and your current living situation.

- Submit Documents: Upload documents like CNIC, proof of income, and any other required paperwork.

- Wait for Confirmation: The authorities will process your registration, and you will be informed if you’re eligible for the scheme.

Apna Ghar Scheme Online Registration Last Date

It’s important to keep an eye on the Apna Ghar scheme registration deadlines. The last date for registration is often announced at the beginning of each year, so make sure to complete your application before the deadline to avoid missing out on this valuable opportunity.

Business Loan – Ghar Scheme

Looking to start a business or expand your existing one? The Business Loan – Ghar Scheme could be the solution you’re looking for. This initiative offers low-interest loans specifically aimed at helping small businesses and entrepreneurs grow.

Business Loan Ghar Scheme Philippines

Although this is primarily for Pakistani citizens, it’s worth noting that similar schemes exist in other countries like the Philippines. For example, in the Philippines, the Business Loan Ghar Scheme allows entrepreneurs to secure financing for their businesses. These schemes usually come with flexible repayment options and low-interest rates, making them attractive for people starting a business or those looking to scale up.

Business Loan Ghar Scheme Interest Rate

The interest rate for the Business Loan Ghar Scheme is typically lower than market rates, making it an affordable option for small businesses. The government ensures that these loans are accessible to entrepreneurs who might otherwise find it difficult to secure financing from traditional banks.

Business Loan Ghar Scheme Calculator

A business loan calculator is available online to help you estimate the amount you can borrow and the monthly repayments. This tool takes into account your business needs, financial situation, and loan terms, allowing you to make an informed decision.

Government Loan for Small Business Philippines

In countries like the Philippines, small business loans are often provided by the government with very favorable terms. These loans are designed to support small businesses by covering operational costs, expansion, and even training programs for business owners.

Startup Business Loan Philippines

For those looking to start a business, the Philippine government offers various startup business loans. These loans are usually available without the need for collateral, making them an excellent choice for first-time entrepreneurs.

Start Up Business Loan Without Collateral Philippines

Some loan programs, especially for startups, offer loans without collateral. This is a game-changer for those who don’t have assets to back up their business loan. However, these loans often come with stricter requirements, such as proving business potential or providing a strong business plan.

DTI Loan for Small Business

The Department of Trade and Industry (DTI) in the Philippines provides small business loans to entrepreneurs who need help to get their businesses off the ground. These loans often come with low interest and favorable repayment options.

BDO Small Business Loan

In addition to government schemes, private banks like BDO in the Philippines also offer small business loans. These loans are a great option for entrepreneurs looking for more flexibility in terms of loan amount and repayment duration.

How to Apply for the Maryam Nawaz Loan Scheme 2026 Online?

The Maryam Nawaz Loan Scheme 2026 is an excellent opportunity for many people to get financial support for housing or business needs. Applying is simple. Here’s how you can do it:

- Visit the Official Portal: Go to the official website where the application forms are hosted.

- Fill Out the Online Application: Provide your personal details, including your CNIC number, income proof, and employment information.

- Submit Required Documents: Make sure you upload all required documents like bank statements, income certificates, and utility bills.

- Wait for Loan Approval: After submission, the authorities will review your application, and you’ll be notified of the status.

FAQs

1. What is the Maryam Nawaz Loan Scheme?

The Maryam Nawaz Loan Scheme offers interest-free loans to Pakistanis for housing and business purposes. It is an initiative by the government to promote homeownership and entrepreneurship.

2. How much loan can I get from the Maryam Nawaz Loan Scheme?

Under the scheme, you can get loans up to 15 lakh rupees for business or housing needs.

3. How can I apply for the Maryam Nawaz Loan Scheme 2026?

You can apply for the scheme online through the official government portal. Simply fill out the application form, submit documents, and wait for approval.

4. What is the Apna Ghar Scheme?

The Apna Ghar Scheme is a government initiative to help low-income families buy homes. It provides affordable housing loans with easy repayment terms.

5. Can I get a loan without collateral in the Business Loan – Ghar Scheme?

Yes, some loan options for startups and small businesses do not require collateral, but you must meet certain criteria to qualify.

6. What is the interest rate for the Business Loan Ghar Scheme?

The interest rate for the Business Loan Ghar Scheme is generally low, making it an affordable option for small businesses.

7. What is the last date for Apna Ghar Scheme 2026 registration?

The last date for Apna Ghar Scheme registration will be announced on the official portal. Make sure to apply before the deadline to avoid missing out.

Conclusion

In 2026, the Maryam Nawaz Loan Scheme and the Apna Ghar Scheme will provide excellent opportunities for people in Pakistan to start businesses, buy homes, and secure financial freedom. Whether you’re looking for a 1500000 loan, a business loan, or a home loan, these government-backed schemes can help you achieve your goals. Make sure to apply online and stay updated on registration deadlines. Best of luck with your financial journey!