Apply for CM Punjab Asaan Karobar Card Loan & Maryam Nawaz Loan Scheme 2026

Are you a small business owner or entrepreneur looking for financial support to grow your business? Whether you’re looking for a business loan or personal financial assistance, you have come to the right place. The CM Punjab Asaan Karobar Card Loan Scheme and the Maryam Nawaz Loan Scheme 2026 are two significant initiatives by the Punjab government that offer accessible loans for various purposes.

Loan Calculator

Calculation Results

- Tier 1: PKR 100,000 - 5,000,000 (Processing Fee: PKR 5,000)

- Tier 2: PKR 5,000,000 - 30,000,000 (Processing Fee: PKR 10,000)

- Interest Rate: Competitive rates as per SBP guidelines

- Repayment: Flexible monthly installments

📱 1786 (Toll Free)

🕒 9:00 AM - 5:00 PM

📍 Punjab Small Industries Corporation

Lahore, Punjab

What is the maximum loan amount?

What documents are required?

How long does the approval process take?

Personal Documents:

- CNIC (Front & Back)

- Passport Size Photo

- Income Certificate

- Bank Statements (6 months)

Business Documents:

- Business Registration

- Trade License

- Tax Returns (2 years)

- Business Plan

- How to Check Your Asaan Karobar Finance Application Status

- Govt of Punjab Announces Latest Rescue 1122 Jobs 2026—Apply Online

- 3737 Ramzan Package 2026 | 9999 & 8070 Online Registration

- Ramzan Package 2026—8171 BISP 14500 & 9999 Online Registration

- Asaan Karobar 2026 Apply Online for Business Loans Up to 3 Crores

- PSER Survey Online Registration for Ramzan Package & Free Atta Rashan 2026

- ASA Pakistan Microfinance | Fast Credit Approval | Loan Application 2026

- Ramzan Package 2026 – Eid Ul Fitr Program 25000 Online Application

- Apply for CM Punjab Asaan Karobar Card Loan & Maryam Nawaz Loan Scheme 2026

- Nigehban Ramzan Package 2026 – 9999 PM Relief 13000 Check

- Apply Now for Ramzan Business Loan Package of Up to 5 Crore!

- Parwaz Card Registration Portal Online Apply Official Website

- Prime Minister Ramzan Package 2026 – Rs. 13,000 Online Check & Apply

- Punjab Asaan Karobar Phase 2—Rs90bn Interest-Free Loans for Small Businesses

- How to Apply for the CM Punjab Loan Scheme 2026 | Asaan Karobar Scheme Online Application Guide

- How to Apply for Maryam Nawaz Livestock Card 2026 | Free Janwar Loan 2000 Dollars Online Application

What Is the CM Punjab Asaan Karobar Card Loan Scheme?

The CM Punjab Asaan Karobar Card Loan Scheme is designed to help small business owners in Punjab access easy financial support. The scheme aims to empower entrepreneurs, especially those in rural and underserved areas, by offering affordable loans to grow or start their businesses. The loan amount can be used for various purposes, such as purchasing inventory, expanding operations, or even paying employees.

- Loan Amount: Varies, with options for both small and medium-sized businesses

- Eligibility: Small business owners, women entrepreneurs, and individuals with viable business ideas

- Interest Rate: Low-interest rates compared to traditional loans

- Repayment Term: Flexible, based on business needs

This loan scheme is a huge relief for many entrepreneurs who may struggle to get funding from traditional financial institutions like banks.

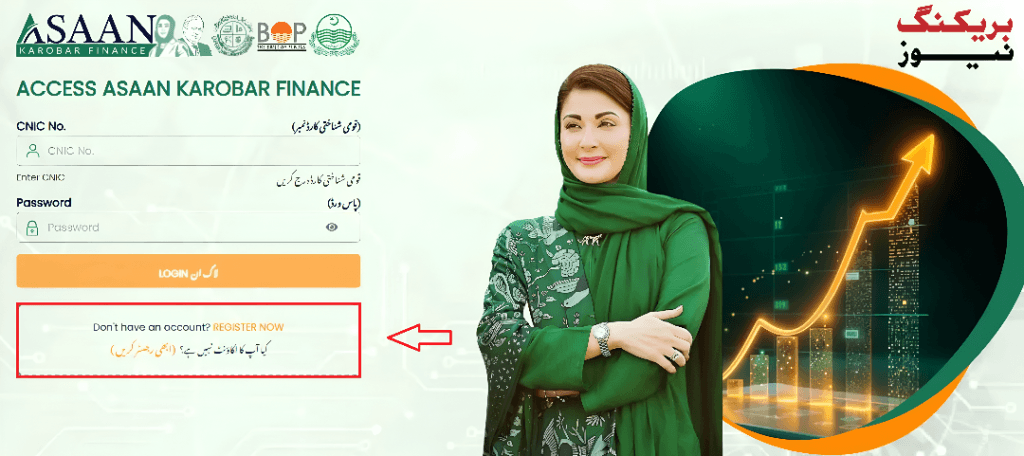

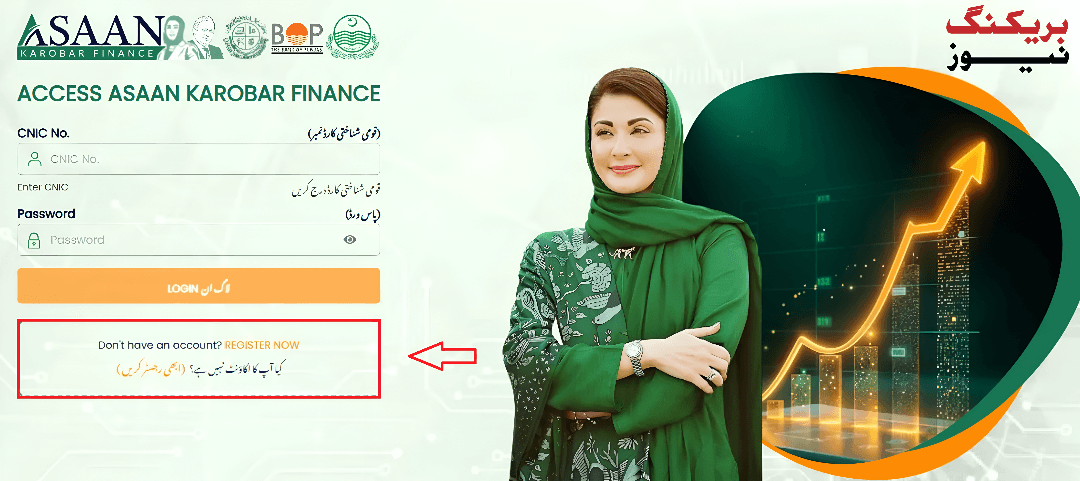

How to Apply for the CM Punjab Asaan Karobar Card Loan Scheme

The application process for the CM Punjab Asaan Karobar Card Loan Scheme is simple and can be done online. Here’s how you can apply:

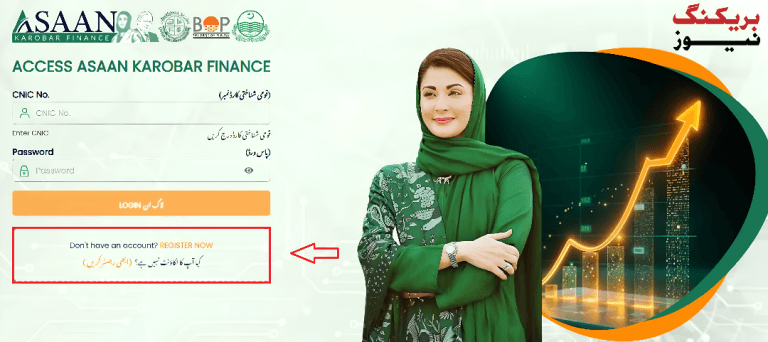

Step 1: Visit the Official Website

To begin the application process, visit the official website of the Punjab Government or the CM Punjab Asaan Karobar scheme portal. There, you will find an online form where you can fill out the necessary details about your business.

Step 2: Fill Out the Application Form

The application form will require you to provide basic personal information, business details, and the loan amount you are requesting. You may also need to include details about your business plan and how the loan will help you grow your business.

Step 3: Submit the Required Documents

To complete your application, you will need to upload certain documents, such as:

- Business Registration: Proof of your business registration or ownership

- CNIC (National Identity Card): A copy of your valid CNIC

- Tax Records: If applicable, proof of your business’s tax filings

- Business Plan: A simple business plan outlining your goals and how you intend to use the loan

Step 4: Loan Approval and Disbursement

Once your application is reviewed, you will receive an approval or rejection notification. If approved, the loan amount will be disbursed to your account. The disbursement typically takes a few days, depending on the processing time.

Step 5: Repayment

The repayment of the loan is flexible, and you can arrange the terms based on your business’s financial capacity. Be sure to keep up with the repayments to avoid any penalties.

CM Punjab Asaan Karobar Card Loan Scheme Calculator

Before applying for the loan, it’s essential to know how much you can borrow and what your monthly payments will be. The CM Punjab Asaan Karobar Card Loan Scheme Calculator is available on the official website to help you calculate the loan amount and understand the repayment schedule. Simply input your required loan amount, and the calculator will provide an estimate of the monthly installment you will need to pay based on the loan tenure and interest rate.

This calculator is a helpful tool to ensure that you are taking on a loan amount that aligns with your business’s financial capacity.

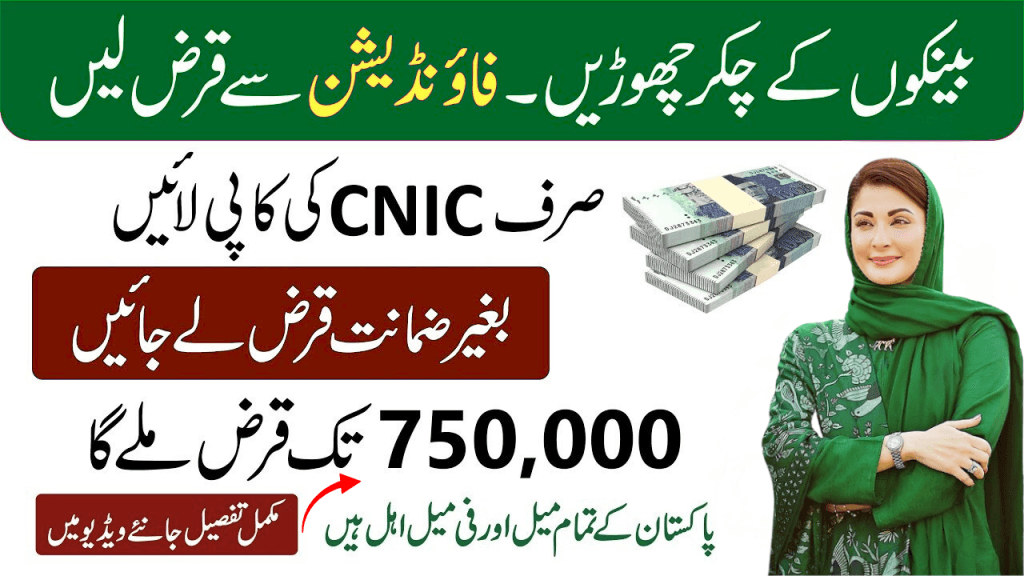

Maryam Nawaz Loan Scheme 2026

The Maryam Nawaz Loan Scheme 2026 is another crucial initiative for individuals and businesses seeking financial support. This scheme is particularly focused on supporting women entrepreneurs, helping them start or expand their businesses.

- Loan Amount: Ranges from 1.5 Lakh to 15 Lakh

- Eligibility: Women entrepreneurs in Pakistan

- Interest Rate: Low-interest loans with flexible repayment options

- Purpose: Can be used for starting a business, expanding operations, or fulfilling personal financial needs.

How to Apply for Maryam Nawaz Loan Scheme 2026

If you’re a woman entrepreneur looking for financial assistance, applying for the Maryam Nawaz Loan Scheme 2026 is a great option. Here’s how you can apply:

- Visit the Official Website: Go to the Maryam Nawaz Loan Scheme application page.

- Complete the Application Form: Provide personal details, business information, and the amount of loan you wish to apply for.

- Submit Documents: Upload your CNIC, business plan, and any other necessary documents.

- Wait for Approval: Once your application is reviewed, you will receive a notification about the approval status.

- Disbursement: If approved, the loan will be disbursed to your account, and you can begin using the funds as needed.

CM Punjab and Maryam Nawaz Loan Schemes

Both the CM Punjab Asaan Karobar Card Loan Scheme and the Maryam Nawaz Loan Scheme offer valuable financial support for businesses and individuals.

| Loan Scheme | Loan Amount | Eligibility | Interest Rate | Purpose |

|---|---|---|---|---|

| CM Punjab Asaan Karobar Card Loan Scheme | Varies (Small to Medium Businesses) | Small Business Owners (Urban & Rural) | Low Interest Rates | Business expansion, inventory purchase, etc. |

| Maryam Nawaz Loan Scheme 2026 | 1.5 Lakh to 15 Lakh | Women Entrepreneurs in Pakistan | Low Interest Rates | Starting or expanding a business |

How Much Loan Can You Get from the Punjab Government?

The Punjab Government Loan Scheme offers loans for various purposes, with the loan amount ranging from a few thousand to several crore rupees. If you’re applying for the CM Punjab Asaan Karobar Loan Scheme, the loan can go up to 3 Crore, depending on your business’s financial needs and the scheme’s terms.

If you’re applying for the Maryam Nawaz Loan Scheme, the loan amount can range from 1.5 lakh to 15 lakh, which is ideal for women entrepreneurs looking to start or grow their business.

How to Apply for a Loan from Punjab Bank

If you prefer to apply for a loan through a traditional bank, Punjab Bank offers various loan products to cater to both personal and business needs. To apply for a loan from Punjab Bank:

- Visit the official Punjab Bank website or visit a nearby branch.

- Fill out the loan application form and provide the required documents (CNIC, proof of income, business plan, etc.).

- Wait for approval and follow the bank’s instructions for disbursement.

For detailed information, you can also visit Punjab Bank’s official page or contact their customer service.

FAQs CM Punjab and Maryam Nawaz Loan Schemes

1. How can I apply for the CM Punjab Asaan Karobar Loan Scheme?

- You can apply online through the official website of the Punjab Government. Fill out the application form, upload the necessary documents, and submit your request.

2. What documents do I need to apply for the Maryam Nawaz Loan Scheme?

- You will need your CNIC, business registration documents (if applicable), and a brief business plan outlining how the loan will be used.

3. Is there any collateral required for the CM Punjab Asaan Karobar Loan?

- No, collateral is not required for the CM Punjab Asaan Karobar Card Loan Scheme. This makes it accessible for many entrepreneurs.

4. What is the loan repayment period for the CM Punjab Asaan Karobar Card Loan Scheme?

- The repayment period is flexible and can be customized based on your business’s ability to repay.

5. Can men apply for the Maryam Nawaz Loan Scheme?

- No, this scheme is specifically designed for women entrepreneurs in Pakistan.

6. How do I check the status of my application?

- You can check your loan application status by logging into your account on the official portal or contacting customer service.

7. How much interest is charged on the CM Punjab Loan Scheme?

- The CM Punjab Asaan Karobar Loan Scheme offers low interest rates, which are much lower than traditional market rates.

Conclusion

Both the CM Punjab Asaan Karobar Card Loan Scheme and the Maryam Nawaz Loan Scheme offer valuable financial support for entrepreneurs and individuals. These schemes are designed to make financial assistance accessible and affordable for those in need. By applying online, you can easily secure funding for your business or personal financial goals. Take advantage of these schemes today and watch your business grow with the support it deserves!