Apply Now for Ramzan Business Loan Package of Up to 5 Crore!

The holy month of Ramzan is a time for reflection, fasting, and prayer. But for business owners, it can also be a time to boost their business and manage increased demand. This year, there’s good news for all entrepreneurs—whether you’re just starting your business or looking to expand—through the Business Loan 5 Crore Ramzan Package. This loan scheme is designed to support businesses by providing financial assistance during these challenging times.

We will explore various loan schemes, including the Asaan Karobar Loan Scheme 2026, Maryam Nawaz Loan Scheme, and CM Punjab Loan Scheme 2026. We will discuss how you can apply for these loans, who is eligible, and how they can help your business grow.

Loan Calculator

Calculation Results

- Tier 1: PKR 100,000 - 5,000,000 (Processing Fee: PKR 5,000)

- Tier 2: PKR 5,000,000 - 30,000,000 (Processing Fee: PKR 10,000)

- Interest Rate: Competitive rates as per SBP guidelines

- Repayment: Flexible monthly installments

📱 1786 (Toll Free)

🕒 9:00 AM - 5:00 PM

📍 Punjab Small Industries Corporation

Lahore, Punjab

What is the maximum loan amount?

What documents are required?

How long does the approval process take?

Personal Documents:

- CNIC (Front & Back)

- Passport Size Photo

- Income Certificate

- Bank Statements (6 months)

Business Documents:

- Business Registration

- Trade License

- Tax Returns (2 years)

- Business Plan

- How to Check Your Asaan Karobar Finance Application Status

- Govt of Punjab Announces Latest Rescue 1122 Jobs 2026—Apply Online

- 3737 Ramzan Package 2026 | 9999 & 8070 Online Registration

- Ramzan Package 2026—8171 BISP 14500 & 9999 Online Registration

- Asaan Karobar 2026 Apply Online for Business Loans Up to 3 Crores

- PSER Survey Online Registration for Ramzan Package & Free Atta Rashan 2026

- ASA Pakistan Microfinance | Fast Credit Approval | Loan Application 2026

- Ramzan Package 2026 – Eid Ul Fitr Program 25000 Online Application

- Apply for CM Punjab Asaan Karobar Card Loan & Maryam Nawaz Loan Scheme 2026

- Nigehban Ramzan Package 2026 – 9999 PM Relief 13000 Check

- Apply Now for Ramzan Business Loan Package of Up to 5 Crore!

- Parwaz Card Registration Portal Online Apply Official Website

- Prime Minister Ramzan Package 2026 – Rs. 13,000 Online Check & Apply

- Punjab Asaan Karobar Phase 2—Rs90bn Interest-Free Loans for Small Businesses

- How to Apply for the CM Punjab Loan Scheme 2026 | Asaan Karobar Scheme Online Application Guide

- How to Apply for Maryam Nawaz Livestock Card 2026 | Free Janwar Loan 2000 Dollars Online Application

What is the Ramzan Business Loan Package?

The Ramzan Business Loan Package is a government initiative aimed at helping business owners by offering loans with low interest rates and flexible repayment plans. With loans up to 5 Crore available, this package is perfect for business owners who need a financial boost during the Ramzan Business Loan Package to meet higher operational costs or expand their businesses.

It’s an excellent opportunity to manage cash flow, pay for extra inventory, or hire additional staff. Let’s take a deeper look at the key loan schemes available.

Asaan Karobar Loan Scheme 2026

The Asaan Karobar Loan Scheme 2026 is one of the key offerings under the government’s initiative. This scheme is designed to help small and medium-sized businesses get access to funds without a lot of paperwork or complex procedures.

- Loan Amount: Up to 5 Crore

- Eligibility: Open to small and medium-sized businesses across Pakistan

- Interest Rate: Lower than market rates, making it an affordable option for business owners

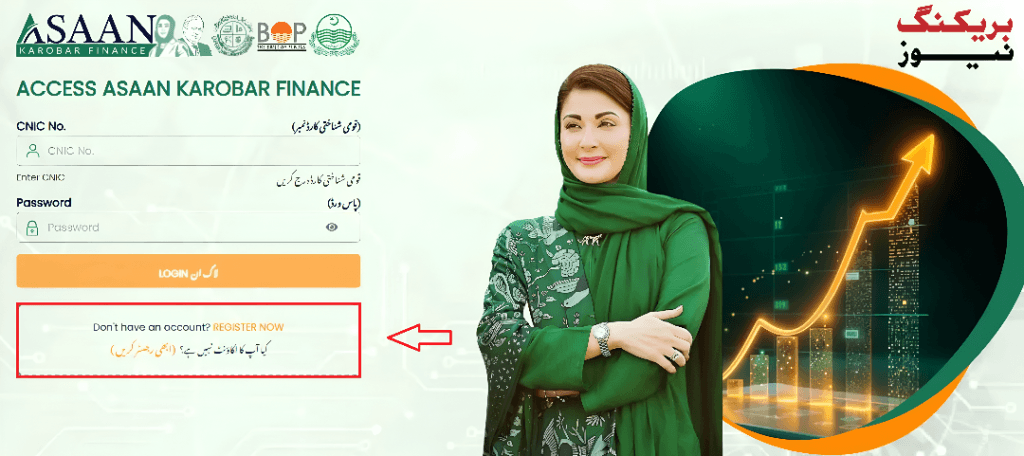

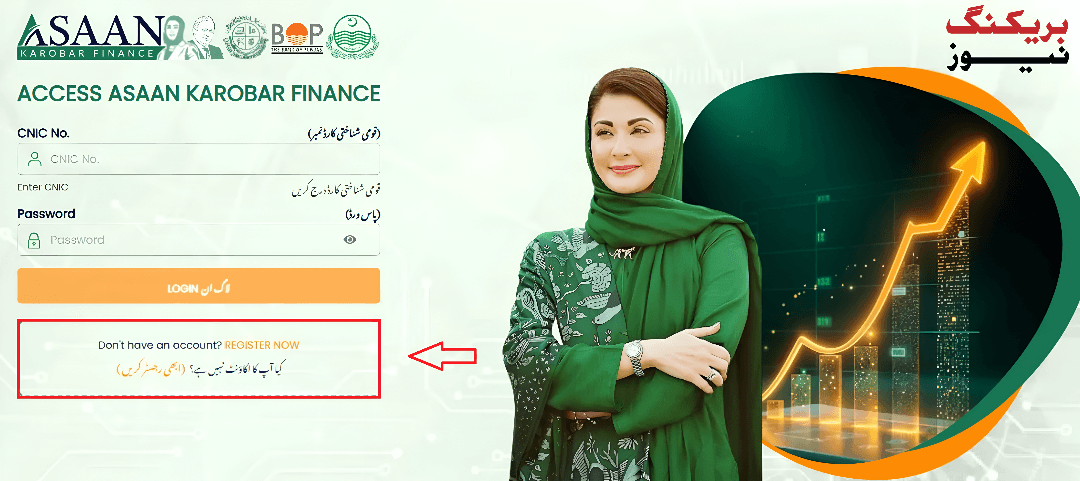

How to Apply for the Asaan Karobar Loan Scheme:

- Visit the Official Portal: Go to the official website of the Asaan Karobar Loan Scheme.

- Fill Out the Application Form: Provide details about your business, including business registration documents, a business plan, and financial statements.

- Submit Documents: Upload all required documents for verification.

- Loan Approval: After reviewing your application, the government will process and approve your loan.

This scheme makes applying for a business loan as easy as possible. You can complete everything online without much hassle.

Maryam Nawaz Loan Scheme 2026

The Maryam Nawaz Loan Scheme 2026 is a government-backed loan program that specifically supports female entrepreneurs. This scheme is part of the broader effort to encourage women to start their own businesses and contribute to Pakistan’s economy.

- Loan Amount: Ranges from 1.5 Lakh to 15 Lakh, depending on the business requirements

- Eligibility: Women entrepreneurs in Pakistan

- Interest Rate: Very low compared to traditional bank loans

How to Apply for the Maryam Nawaz Loan Scheme:

- Visit the Maryam Nawaz Loan Scheme Website: Go to the official portal for the loan scheme.

- Fill Out the Application Form: Provide your personal and business details.

- Submit Documents: Upload required documents, such as your CNIC, business registration, and any financial records.

- Wait for Approval: Once your application is processed, you will be notified of the approval status.

This scheme is an excellent opportunity for women looking to kickstart or expand their businesses with government support.

CM Punjab Loan Scheme 2026

The CM Punjab Loan Scheme 2026 is specifically for businesses operating within Punjab. It aims to support entrepreneurs in the province with low-interest loans. This scheme is particularly focused on small businesses in underserved areas of the province, providing opportunities for growth and development.

- Loan Amount: Varies depending on the business size and need

- Eligibility: Available to businesses based in Punjab

- Interest Rate: Extremely competitive, with a focus on making business loans accessible

How to Apply for the CM Punjab Loan Scheme:

- Go to the CM Punjab Loan Scheme Website: Access the official platform where you can apply.

- Complete the Application Form: Provide all necessary information about your business, including your location and financial details.

- Submit Documents: Attach all required documents for verification.

- Application Review and Approval: After submission, your loan application will be processed and reviewed.

This scheme is ideal for Punjab-based businesses, whether you’re in Lahore, Multan, or any other city in the province.

Loan Scheme Overview Comparison

To help you understand the differences between the various loan schemes, here’s a quick comparison:

| Loan Scheme | Loan Amount | Eligibility | Interest Rate | Application Process |

|---|---|---|---|---|

| Asaan Karobar Loan Scheme | Up to 5 Crore | Small & medium-sized businesses | Low interest rate | Online application |

| Maryam Nawaz Loan Scheme | 1.5 Lakh to 15 Lakh | Women entrepreneurs | Low interest rate | Online application |

| CM Punjab Loan Scheme | Varies | Businesses based in Punjab | Competitive rates | Online application |

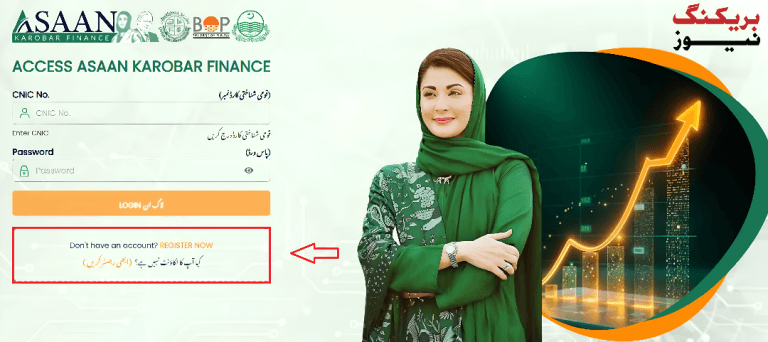

How to Check the Status of Your Loan Application?

Once you’ve applied for your business loan, it’s important to track its progress. Here’s how you can check the status:

- Visit the Official Portal: Go to the website where you applied for your loan.

- Login to Your Account: Enter your login details to access your application.

- Check the Status: You will see if your application is under review, approved, or rejected.

This process is quick and straightforward, ensuring that you’re always aware of where your application stands.

Tips for a Successful Loan Application

To improve your chances of getting approved for a loan, consider these tips:

- Have All Your Documents Ready: Make sure your business registration, tax records, and financial statements are up-to-date.

- Be Clear About the Loan Amount You Need: Don’t apply for more money than you need. A precise loan amount can speed up your approval.

- Write a Clear Business Plan: A well-written business plan shows that you are serious about your business and have a clear vision for its future.

- Maintain a Good Credit History: Even though these loans are easier to obtain, having a good credit history will help your application get approved faster.

- Follow Up: After applying, don’t hesitate to check the status of your Ramzan Business Loan Package application.

FAQs About Business Loan Schemes

1. How do I apply for the Maryam Nawaz Loan Scheme?

- To apply, visit the official website, fill out the application form, and submit the required documents online.

2. How much can I borrow under the Asaan Karobar Loan Scheme?

- You can borrow up to 5 crore under the Asaan Karobar Loan Scheme or the Ramzan Business Loan Package, depending on your business’s needs.

3. Who is eligible for the CM Punjab Loan Scheme?

- Businesses based in Punjab can apply for this scheme. It’s specifically aimed at supporting local entrepreneurs.

4. What documents do I need to apply for a business loan?

- You’ll need to provide business registration details, financial statements, and other relevant documents such as your CNIC and tax records.

5. How long does it take to get the loan approval?

- The approval process typically takes a few weeks, depending on the loan scheme and the completeness of your application.

6. Are the interest rates on these loans high?

- No, the interest rates are relatively low compared to the traditional commercial bank Ramzan Business Loan Package, making them more affordable for business owners.

7. Can I apply for a loan if I don’t have any assets to pledge?

- Yes, especially under the Asaan Karobar Loan Scheme, which doesn’t require collateral.

Conclusion

With the launch of the Business Loan 5 Crore Ramzan Package, small business owners across Pakistan have a great opportunity to secure financing and grow their operations. Whether you’re applying for the Asaan Karobar Loan Scheme, the Maryam Nawaz Loan Scheme, or the CM Punjab Loan Scheme, these loans offer low interest rates and flexible terms, making it easier for entrepreneurs to succeed.

So, if you need a financial boost this Ramzan Business Loan Package, don’t miss out on these great opportunities. Apply now and take your business to the next level!