ASA Pakistan Microfinance | Fast Credit Approval | Loan Application 2026

Are you a small business owner, an entrepreneur, or someone in need of quick financial help? The search for a reliable loan option in Pakistan has never been easier. Thanks to platforms like ASA Pakistan Microfinance, applying for a loan has become simpler, faster, and more accessible. With the Loan Application ASA Pakistan Microfinance service, individuals can now get fast approval for loans ranging from personal loans to small business loans.

ASA loan application process, how to apply online, and what makes ASA Pakistan Microfinance a trusted provider in the country. If you’re looking for a loan app in 2026 that offers fast approval.

Loan Calculator

Calculation Results

- Tier 1: PKR 100,000 - 5,000,000 (Processing Fee: PKR 5,000)

- Tier 2: PKR 5,000,000 - 30,000,000 (Processing Fee: PKR 10,000)

- Interest Rate: Competitive rates as per SBP guidelines

- Repayment: Flexible monthly installments

📱 1786 (Toll Free)

🕒 9:00 AM - 5:00 PM

📍 Punjab Small Industries Corporation

Lahore, Punjab

What is the maximum loan amount?

What documents are required?

How long does the approval process take?

Personal Documents:

- CNIC (Front & Back)

- Passport Size Photo

- Income Certificate

- Bank Statements (6 months)

Business Documents:

- Business Registration

- Trade License

- Tax Returns (2 years)

- Business Plan

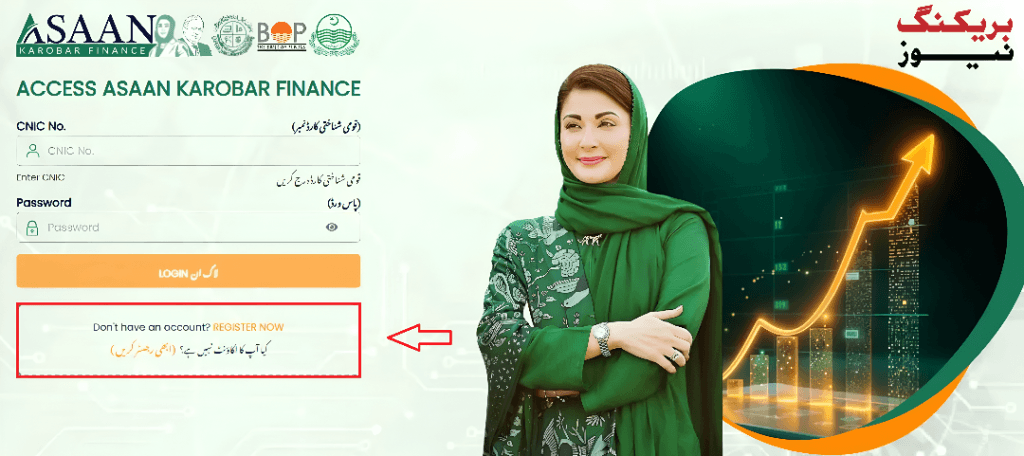

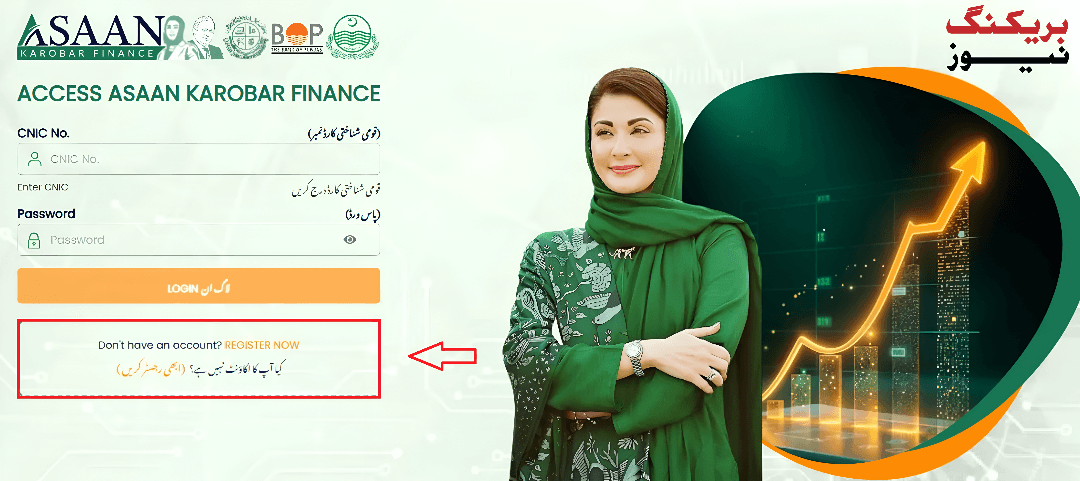

- How to Check Your Asaan Karobar Finance Application Status

- Govt of Punjab Announces Latest Rescue 1122 Jobs 2026—Apply Online

- 3737 Ramzan Package 2026 | 9999 & 8070 Online Registration

- Ramzan Package 2026—8171 BISP 14500 & 9999 Online Registration

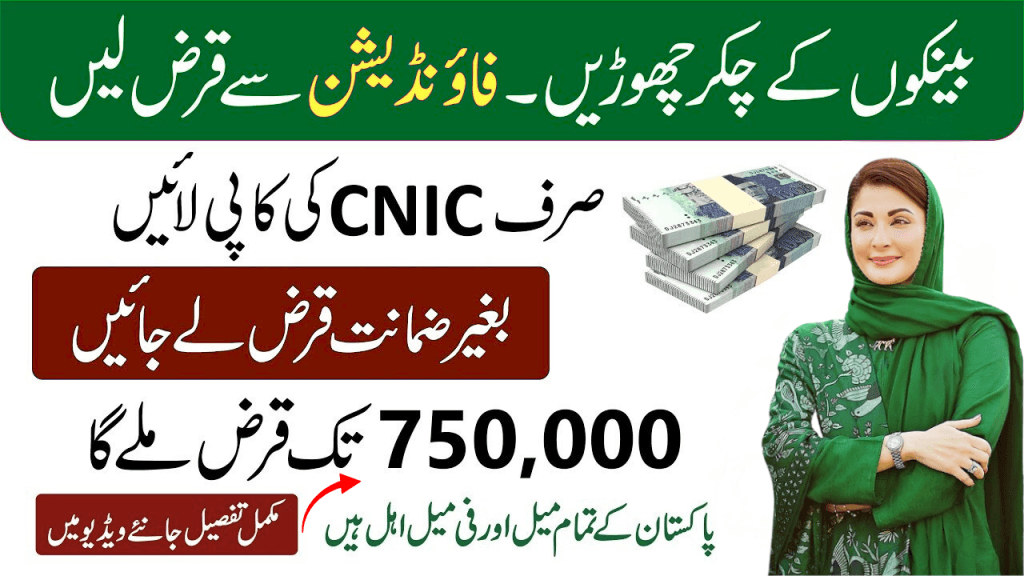

- Asaan Karobar 2026 Apply Online for Business Loans Up to 3 Crores

- PSER Survey Online Registration for Ramzan Package & Free Atta Rashan 2026

- ASA Pakistan Microfinance | Fast Credit Approval | Loan Application 2026

- Ramzan Package 2026 – Eid Ul Fitr Program 25000 Online Application

- Apply for CM Punjab Asaan Karobar Card Loan & Maryam Nawaz Loan Scheme 2026

- Nigehban Ramzan Package 2026 – 9999 PM Relief 13000 Check

- Apply Now for Ramzan Business Loan Package of Up to 5 Crore!

- Parwaz Card Registration Portal Online Apply Official Website

- Prime Minister Ramzan Package 2026 – Rs. 13,000 Online Check & Apply

- Punjab Asaan Karobar Phase 2—Rs90bn Interest-Free Loans for Small Businesses

- How to Apply for the CM Punjab Loan Scheme 2026 | Asaan Karobar Scheme Online Application Guide

- How to Apply for Maryam Nawaz Livestock Card 2026 | Free Janwar Loan 2000 Dollars Online Application

What is ASA Pakistan Microfinance?

ASA Pakistan Microfinance is a leading institution that offers financial services to low-income individuals and small businesses. It aims to help people with limited access to traditional banking services by providing microloans with easy terms. The goal is to empower underserved communities by offering financial support that helps them grow their businesses, improve their livelihoods, and meet personal financial needs.

ASA Pakistan provides a bridge for people who don’t have access to mainstream financial services, ensuring they can get the money they need for various purposes.

Why Choose ASA Pakistan Microfinance?

Before we dive into the specifics of the loan application, let’s discuss why ASA Pakistan Microfinance stands out in the competitive loan market.

- Quick Loan Processing: ASA Pakistan offers fast approval for loans, with the application process being simple and quick. You can receive funds in a matter of days once your application is approved.

- Affordable Loan Terms: The interest rates are low compared to traditional loans, making them a great option for individuals and small businesses looking for affordable financial solutions.

- No Collateral Required: One of the standout features of ASA loans is that you don’t need to provide collateral. This is particularly helpful for individuals who don’t have assets to pledge but still need financial support.

- Multiple Loan Options: ASA Pakistan offers a variety of loan products, such as personal loans, small business loans, and agricultural loans. This diversity allows applicants to choose the loan that best fits their needs.

- Branch Network: ASA has a widespread network of branches across Pakistan, making it accessible for people living in different regions, from major cities to rural areas.

Types of Loans Offered by ASA Pakistan Microfinance

ASA Pakistan offers several types of loans to meet the different needs of its customers. Here’s a breakdown:

- Small Business Loans: Ideal for entrepreneurs looking to start or expand their businesses. These loans can be used for purchasing equipment, paying wages, or expanding inventory.

- Personal Loans: These loans are designed for individuals who need funds for personal reasons, such as medical expenses, education, or home repairs.

- Agricultural Loans: Specifically designed for farmers and individuals in the agriculture sector. These loans help in purchasing seeds, fertilizers, and other necessary materials for farming.

- Emergency Loans: For urgent financial needs, ASA Pakistan offers emergency loans with fast approval processes.

ASA Loan Application Process

Applying for a loan with ASA Pakistan is straightforward. Here’s a step-by-step guide on how you can apply:

Step 1: Choose the Loan Product

The first step in the application process is to determine which loan product you need. Whether it’s a small business loan, personal loan, or agricultural loan, ASA offers options for each type of financial need.

Step 2: Fill Out the ASA Loan Application Form

ASA Pakistan Microfinance website to access the loan application form. The form requires you to provide details like your personal information, business information (if applicable), the loan amount you’re requesting, and the purpose of the loan.

If you are applying for a small business loan, you may also need to provide additional information such as your business plan and financial records.

Step 3: Submit Documents for Verification

After filling out the application form, you will need to submit certain documents for verification. These could include:

- CNIC (Computerized National Identity Card)

- Proof of income or employment (for personal loans)

- Business registration documents (for small business loans)

- Financial statements (for business loans)

Ensure all your documents are valid and up-to-date to avoid delays in the approval process.

Step 4: Online Application (Optional)

ASA Pakistan also offers the option to apply online through their mobile app or website. The online process is quick and allows you to track the status of your loan application in real time.

- ASA Loan Online Apply: You can easily apply for the loan online by filling out the application form and uploading the required documents. The process is similar to the in-branch application but can be done from the comfort of your home.

Step 5: Loan Approval and Disbursement

Once your application has been submitted and reviewed, you will receive a decision regarding your loan application. If approved, the loan amount will be disbursed to your account within a few days.

Step 6: Repayment

The repayment process is simple and flexible. You can make monthly payments based on the terms of your loan agreement. ASA provides various payment methods, including direct bank transfers and mobile payments.

Where Can I Apply for ASA Loans?

ASA Pakistan has branches all over the country, including in major cities like Karachi, Lahore, Rawalpindi, and Islamabad, as well as in rural areas. To find the nearest branch or apply online, visit their official website.

If you are looking for “ASA Loan Online Apply near Rawalpindi” or “ASA Pakistan Branches near me,” simply use the search feature on their website or contact their customer support team for more details.

- ASA Pakistan Branches Near Me: Check their website for the branch locator or use the online application if you prefer convenience.

- Ayesha Pakistan Loan Contact Number WhatsApp Number: If you need any assistance, you can also get in touch with ASA Pakistan’s customer service through their official WhatsApp number or contact details listed on their website.

What Makes an ASA Loan Application Stand Out?

Here’s why ASA Pakistan’s loan application process is worth considering:

- Speed: The approval process is fast. You don’t have to wait long for your loan to be approved or disbursed.

- Ease of Access: You can apply both online and in person, making it accessible for everyone, regardless of location.

- Customer Support: ASA Pakistan offers excellent customer support to guide you through the application process. Whether you have questions about the application form or loan terms, they are ready to assist.

- Flexible Terms: The repayment terms are flexible and can be adjusted according to your needs, making it easier to pay back the loan.

FAQs ASA Pakistan Microfinance Loans

1. How can I apply for an ASA loan?

- You can apply for an ASA loan by visiting their website, filling out the loan application form, and submitting the required documents. Alternatively, you can apply online through their mobile app.

2. What documents are required for the ASA loan application?

- You will need your CNIC, proof of income, business registration (if applying for a business loan), and any other documents specific to the type of loan you’re applying for.

3. How long does it take to get approved for an ASA loan?

- The loan approval process is quick and usually takes a few days. You’ll be notified once your loan is approved.

4. Can I apply for a loan if I don’t have collateral?

- Yes, ASA loans do not require collateral, which makes it easier for individuals without assets to apply and get approved.

5. Is the ASA loan app available for download?

- Yes, ASA Pakistan has a mobile app that allows you to apply for loans, track your loan status, and receive funds quickly.

6. How can I check the status of my ASA loan application?

- You can check the status of your application by logging into your account on the ASA Pakistan website or mobile app.

Conclusion

ASA Pakistan Microfinance is one of the best loan providers in Pakistan, offering easy, accessible, and quick loan options for individuals and businesses. Whether you’re in need of a personal loan, a business loan, or agricultural funding, ASA Pakistan provides loans with fast approval and affordable repayment terms. With multiple branches across the country and a simple online application process, getting a loan has never been easier. So, if you’re looking for fast financial assistance, ASA Pakistan is the perfect solution.