Eligibility Criteria of Asaan Karobar Finance Scheme 2025 Apply Now!

Asaan Karobar Finance Scheme is designed to help small business owners and new entrepreneurs in Punjab by offering interest-free loans. This program supports people who want to start or grow their own business, create jobs, and boost the local economy. To get your loan approved, you’ll need to meet some basic eligibility criteria and avoid common mistakes during the application process.

What is the Asaan Karobar Finance Scheme?

The Asaan Karobar Finance Scheme is a loan program started by the government. Its main purpose is to help small business owners, shopkeepers, and young people get easy loans with low interest. This scheme is made for people who don’t have a lot of money or a long bank record. The goal is to make getting business loans simple and possible for everyone.

Note: While Asaan Qarza Scheme 2021 and Asaan Qarza Scheme 2022 are similar in spirit, the Asaan Karobar Finance Scheme is specifically for Punjab-based businesses and is distinct from national Ehsaas or BISP programs.

Benefits of Asaan Karobar Finance Scheme

How to Apply for Asaan Karobar Finance Scheme

Who Can Apply? (Eligibility Criteria)

Let’s get straight to the point. Not everyone can apply for this loan. Here’s what you need:

If you meet these simple conditions, you’re good to go!

Quick Eligibility Checklist

| Requirement | Details |

| Age | 18-60 years |

| Nationality | Pakistani (with CNIC) |

| Business Type | New or existing small business |

| Location | Punjab/Relevant Province |

| Credit History | No default with any bank |

| Income Level | Low/Middle income (priority) |

| Guarantor | Usually required |

ASA Lending Requirements

Now, let’s talk about what banks actually look for when you apply for this loan.

ASA Loan Requirements

Let’s get into the nitty-gritty. What do you actually need to get this loan?

ASA Guarantor

This is important! Most banks will ask for a guarantor. But what does that mean?

A guarantor is someone who promises to pay back the loan if you can’t. Usually, it’s a family member, friend, or someone you trust. The guarantor must have a steady income and a clean credit history.

Who Can Be a Guarantor?

| Who Qualifies? | Who Doesn’t? |

| Employed person | Someone with bad credit history |

| Business owner | Unemployed person |

| Government employee | Someone already a guarantor |

| Trusted community member | Minor (under 18) |

Common Reasons for Rejection

Additional Information

FAQ

Who is eligible for the Asaan Karobar Finance Scheme?

Eligibility criteria for the Asaan Karobar Finance Scheme include being a Pakistani citizen aged 18–60, having a valid CNIC, running a business in Punjab, having a clean credit history, and being a low- or middle-income individual. A guarantor is usually required.

How is the Asaan Karobar Finance Scheme different from Ehsaas Asan Qarza or BISP?

While Ehsaas Asan Qarza, Ehsaas Kafalat Program, and BISP are national social protection programs, the Asaan Karobar Finance Scheme is specifically for business owners in Punjab, focusing on business loans rather than cash grants or scholarships.

What documents are required to apply for the Asaan Karobar Finance Scheme?

You need a valid CNIC, recent photographs, proof of business (like a shop license or utility bill), guarantor details, and sometimes a bank statement. The application form is available online or at participating banks.

What is the loan amount and repayment period under the Asaan Karobar Finance Scheme?

The loan amount typically ranges from Rs. 50,000 to Rs. 1,000,000 (limits may vary). The repayment period and terms depend on the specific guidelines of the scheme.

What are the common reasons for rejection in the Asaan Karobar Finance Scheme?

Common reasons include incomplete documents, incorrect information, lack of a guarantor, bad credit history, or not meeting age or location criteria.

How can I check my eligibility for the Asaan Karobar Finance Scheme?

You can check your eligibility by reviewing the official Asaan Karobar Finance Scheme eligibility criteria on the government or bank website, or by visiting your nearest participating bank branch.

Where can I download the Asaan Karobar Finance Scheme eligibility criteria PDF?

The Asaan Karobar Finance Scheme eligibility criteria PDF is usually available on the official Punjab government or bank websites. You can also request it at your nearest bank branch.

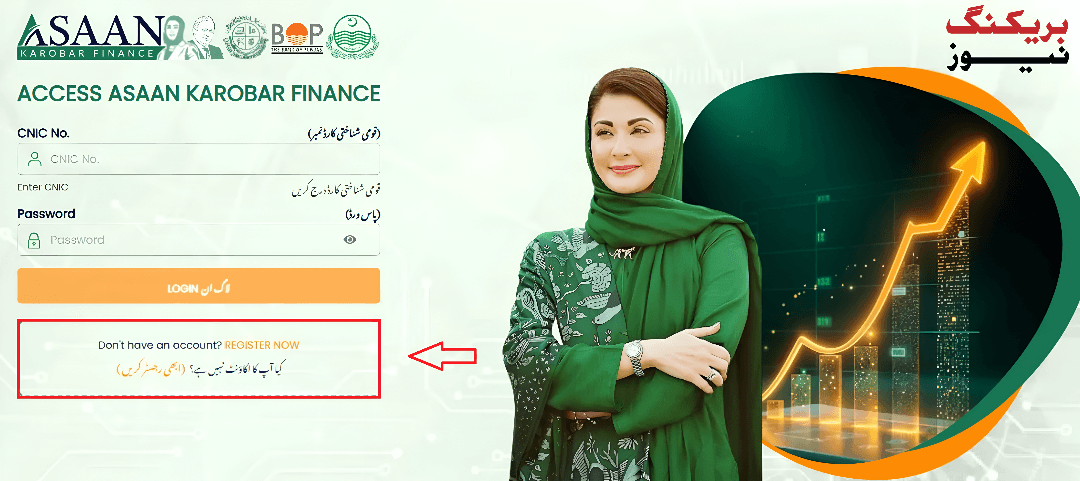

Is there an online application for the Asaan Karobar Finance Scheme?

Yes, many banks offer online application options for the Asaan Karobar Finance Scheme. Check the official website or your nearest bank for details.

What is the interest rate for the Asaan Karobar Finance Scheme?

The Asaan Karobar Finance Scheme offers loans at low or zero interest rates to eligible applicants, making it easier for small businesses to access finance.

Can existing businesses apply for the Asaan Karobar Finance Scheme?

Yes, both new and existing small businesses in Punjab can apply for the Asaan Karobar Finance Scheme.

What is the difference between Asaan Karobar Finance Scheme and Asaan Qarza Scheme?

The Asaan Karobar Finance Scheme is specifically for business owners in Punjab, while the Asaan Qarza Scheme is a broader national loan program for individuals, not limited to business purposes.

How do I track my Asaan Karobar Finance Scheme application status?

You can track your application status by contacting your bank or checking online through the official portal, if available.

Are there any fees for applying to the Asaan Karobar Finance Scheme?

There are usually no application fees for the Asaan Karobar Finance Scheme, but always check with your bank for the latest information.

Conclusion

The Asaan Karobar Finance Scheme (2025) is a golden chance for small business owners and new entrepreneurs in Pakistan. With simple requirements, low markup, and fast approval, it’s designed for you. Just follow the steps, keep your documents ready, and take the first step toward your business dream.

If you still have questions, visit your nearest bank or check the official website. Don’t let paperwork or confusion stop you—opportunity is just one application away!