Everything You Need to Know About Asaan Karobar Card Eligibility

If you’re from Punjab, Pakistan, and dream of starting or growing your own business, the Asaan Karobar Card is a golden chance. Let’s break down everything in plain, simple words so anyone can understand.

What Is the Asaan Karobar Card?

The Asaan Karobar Card is a special loan scheme by the Chief Minister of Punjab. It gives young entrepreneurs up to PKR 1 million as an interest-free loan to start or expand a business. The goal? Make business dreams come true for ordinary folks.

Why Should You Care?

Most people want to start a business but don’t have money. Banks ask for too much paperwork and interest. The Asaan Karobar Card is different—it’s easy, digital, and interest-free. If you qualify, you get a loan and a card to spend the money.

Eligibility Criteria for Asaan Karobar Card

Let’s get to the heart of it—who can apply? Here’s a simple list:

Extra Tips

If you’re a tax filer, it’s a plus but not always required right away. You’ll need some documents—like your CNIC, business proof, and references. Keep these ready before you apply.

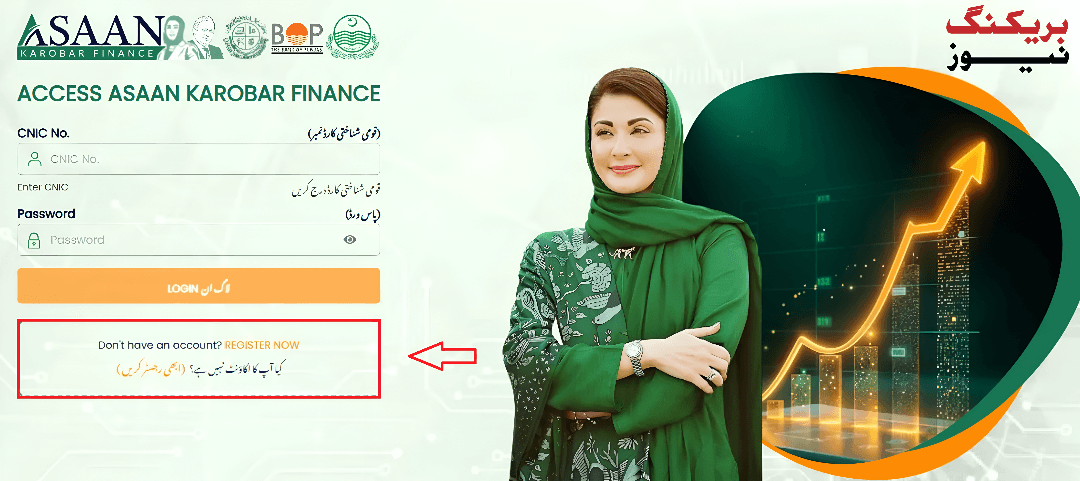

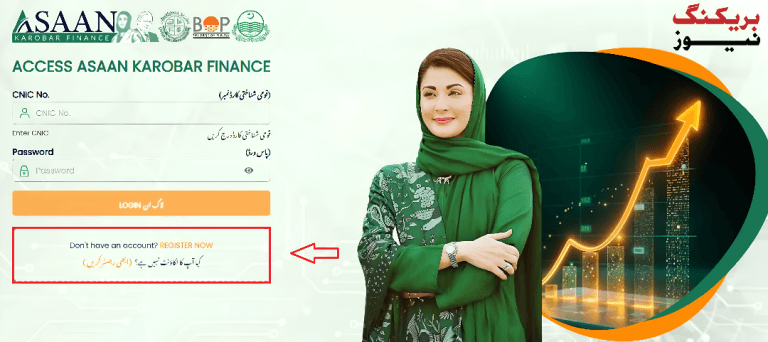

How to Apply for Asaan Karobar Card Online

Applying is easier than you think. Here’s how it works:

- Visit the Official Website: Go to akc.punjab.gov.pk

- Register: Use your CNIC and registered mobile number to create an account

- Fill the Form: Enter your details, business info, and upload documents

- Pay the Fee: There’s a small non-refundable fee (PKR 500) to process your application

- Submit and Wait: After submission, you’ll get a tracking number. Wait for updates

What Happens After You Apply?

Your application goes through several checks:

If everything checks out, you get the card and the money!

Common Mistakes to Avoid

Loan Usage and Repayment

You get a 3-month grace period after getting the card. After that, you start paying back in monthly installments. The minimum payment is 5% of your outstanding balance each month.

Important Guidelines

Comparing Asaan Karobar Card with Other Schemes

Here’s a quick table to compare the Asaan Karobar Card with other popular schemes:

| Scheme | Who Can Apply? | Loan Amount | Interest | Key Benefit |

|---|---|---|---|---|

| Asaan Karobar Card | Punjab residents, 21-57 years | Up to PKR 1 million | None | Interest-free, easy process |

| Ehsaas Program | Low-income, unemployed | Cash grant | None | Financial aid for poor |

| Ehsaas Kafalat | Women, disabled, orphans | Cash grant | None | Support for vulnerable |

| BISP | Poor households | Cash grant | None | Poverty reduction |

| Sehat Card | Punjab residents | Health insurance | None | Free medical treatment |

Other Popular Eligibility Criteria (For Reference)

Let’s look at some other schemes people search for. It helps you see the difference.

Padho Pardesh Scheme Eligibility

Ehsaas Program Eligibility

Ehsaas Kafalat Program

BISP Eligibility

Sehat Card Eligibility

Ehsaas Scholarship

Tips to Make Your Application Stand Out

My Experience with Asaan Karobar Card

Last year, my cousin applied for the Asaan Karobar Card. He runs a small grocery shop in Lahore. The process was smooth—just a few steps online, a small fee, and some waiting. After a month, he got the card and used the money to stock up his shop. Now, his business is growing!

Info Box: Quick Facts

FAQs

Can I apply if my business is not registered?

You can apply if you plan to start a business or already have one in Punjab

Do I need to be a tax filer?

It helps, but it’s not always required at the start. You’ll need to become a filer within six months of getting the loan

How do I check my application status?

You’ll get a tracking number after applying. Check online or call the helpline

What documents do I need?

CNIC, business proof, references, and a passport-size photo

Is the loan really interest-free?

Yes, there’s no interest on the loan

What happens if I don’t pay back the loan?

You’ll face penalties, and your card may be blocked. Always pay on time

Conclusion

The Asaan Karobar Card is a game-changer for small business owners in Punjab. It’s easy to apply, interest-free, and designed for real people. If you meet the eligibility criteria, don’t wait—apply today and take the first step toward your business dreams!