How To Apply Asaan Karobar Card Step-by-Step Process

Asaan Karobar Card was started by Punjab’s Chief Minister, Maryam Nawaz. This card is made to help young people start new businesses or improve the ones they already have. With this scheme, you can get an interest-free loan of up to 10 lakh rupees using a special digital card. If you want to apply, just follow the easy steps given below.

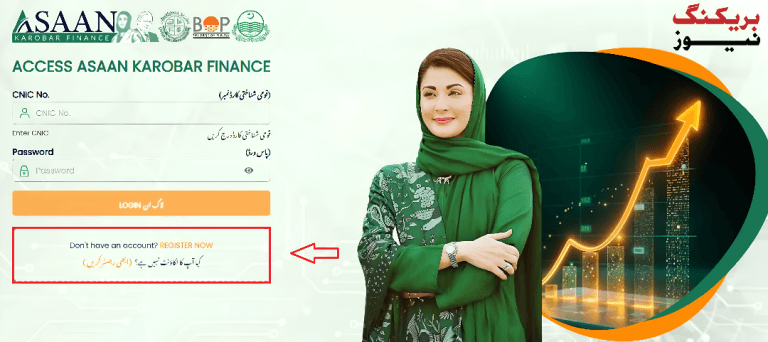

Apply Asaan Karobar Card

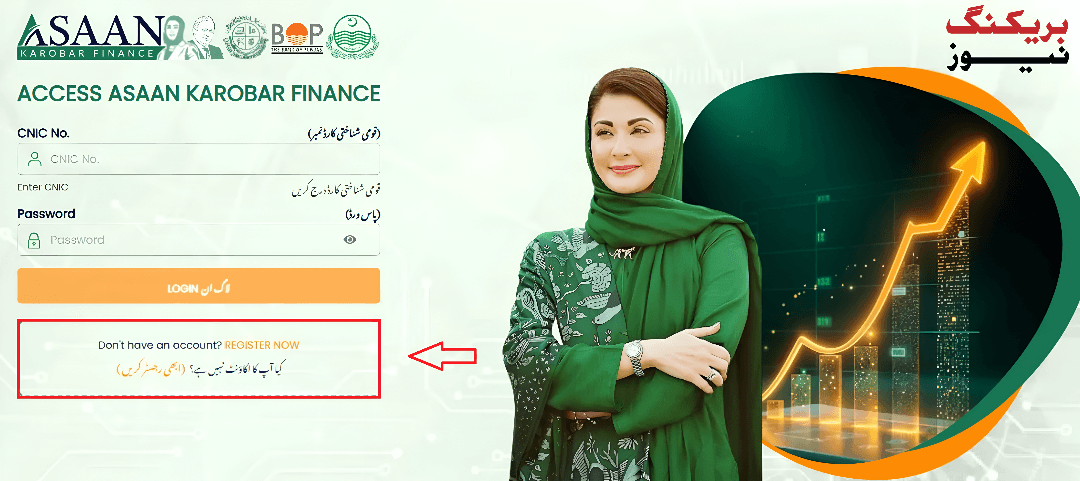

To apply Visit the Asaan Karobar Card website, register with your CNIC, fill the application, upload documents, and submit online. Here’s how you do it, step by step.

Step 1: Go to the Official Website

Step 2: Click “Register Now”

Step 3: Fill Out Your Profile Information

You’ll see a form. Fill in these details:

Set a password and confirm it. Make sure you remember this password!

Step 4: Submit and Confirm

Step 5: Log In to Your Account

Step 6: Fill Personal and Business Information

Once logged in, you’ll see your dashboard.

Now fill in:

If you’re starting a new business, just write your business idea and plan.

Step 7: Add Loan Details

Step 8: Upload Documents

Attach clear photos or scans of:

Step 9: Review and Submit

Step 10: Wait for Confirmation

Step 11: Get Your Card

Why Apply for the Asaan Karobar Card?

Honestly, it’s a golden chance for anyone dreaming of running their own shop, salon, store, or any small business.

Who Can Apply? (Eligibility Criteria)

Before you start, check if you fit these requirements:

What Documents Do You Need?

Keep these ready before you start your application:

Conclusion

The Asaan Karobar Card 2025 is a life-changing opportunity for anyone in Punjab dreaming of starting or growing a small business.

The process is simple, the support is real, and the benefits are huge.

Don’t wait—get your documents ready, follow these easy steps, and grab your chance to shine.

FAQs

Is the loan really interest-free?

Yes, there’s no interest or markup for three years.

How much money can I get?

Up to Rs. 10 lakh (1 million) on the card.

Can I apply if I live in a village?

Yes, as long as you live in Punjab and meet the other requirements.

How will I get the money?

You’ll get an ATM-style card to use for business payments and cash withdrawals.

What if I lose my card?

Contact the issuing bank or helpline right away to block and replace your card.

What happens if I can’t repay on time?

Late payments may affect your credit record and future loan chances.