How to Apply for Asaan Karobar Card Process Explained

Want to start or grow your business in Punjab? The Asaan Karobar Card is here to help. It’s like a magic card—it gives you money for your business, no interest! Here’s everything you need to know, step by step, in super simple language.

Loan Calculator

Calculation Results

- Tier 1: PKR 100,000 - 5,000,000 (Processing Fee: PKR 5,000)

- Tier 2: PKR 5,000,000 - 30,000,000 (Processing Fee: PKR 10,000)

- Interest Rate: Competitive rates as per SBP guidelines

- Repayment: Flexible monthly installments

📱 1786 (Toll Free)

🕒 9:00 AM - 5:00 PM

📍 Punjab Small Industries Corporation

Lahore, Punjab

What is the maximum loan amount?

What documents are required?

How long does the approval process take?

Personal Documents:

- CNIC (Front & Back)

- Passport Size Photo

- Income Certificate

- Bank Statements (6 months)

Business Documents:

- Business Registration

- Trade License

- Tax Returns (2 years)

- Business Plan

- How to Check Your Asaan Karobar Finance Application Status

- Govt of Punjab Announces Latest Rescue 1122 Jobs 2026—Apply Online

- 3737 Ramzan Package 2026 | 9999 & 8070 Online Registration

- Ramzan Package 2026—8171 BISP 14500 & 9999 Online Registration

- Asaan Karobar 2026 Apply Online for Business Loans Up to 3 Crores

- PSER Survey Online Registration for Ramzan Package & Free Atta Rashan 2026

- ASA Pakistan Microfinance | Fast Credit Approval | Loan Application 2026

- Ramzan Package 2026 – Eid Ul Fitr Program 25000 Online Application

- Apply for CM Punjab Asaan Karobar Card Loan & Maryam Nawaz Loan Scheme 2026

What Is the Asaan Karobar Card?

It’s a special government loan card. You get money for your business. No interest. You pay back only what you borrow. It’s for small business owners and new entrepreneurs in Punjab.

Who Needs It?

- Anyone with a small business.

- Anyone who wants to start a business.

- Anyone who needs cash to buy stock, pay bills, or upgrade.

Why’s it popular?

Because it’s easy and fast, and you don’t pay extra. Over 80,000 people already got it!

Who Can Apply? (Eligibility)

You must check if you fit the rules. Here they are:

- Age: 21 to 57 years old

- Live in Punjab: Your business must be in Punjab

- CNIC: You need a valid Pakistani CNIC

- Mobile Number: Your phone must be registered with your CNIC

- Clean Credit: No unpaid loans or bad credit history

- Business: You own a small business or have a business idea

Tip: If you’re a woman, transgender, or differently abled, you get extra help.

Documents You Need

Gather these before you start:

- CNIC: Front and back copies

- Mobile Number: Must match your CNIC

- Business Proof: Lease, shop photo, or business documents

- Bank Statement: If you have a business account

- Photo: Sometimes needed, but not alway

Double-check everything. Wrong info means delay or rejection.

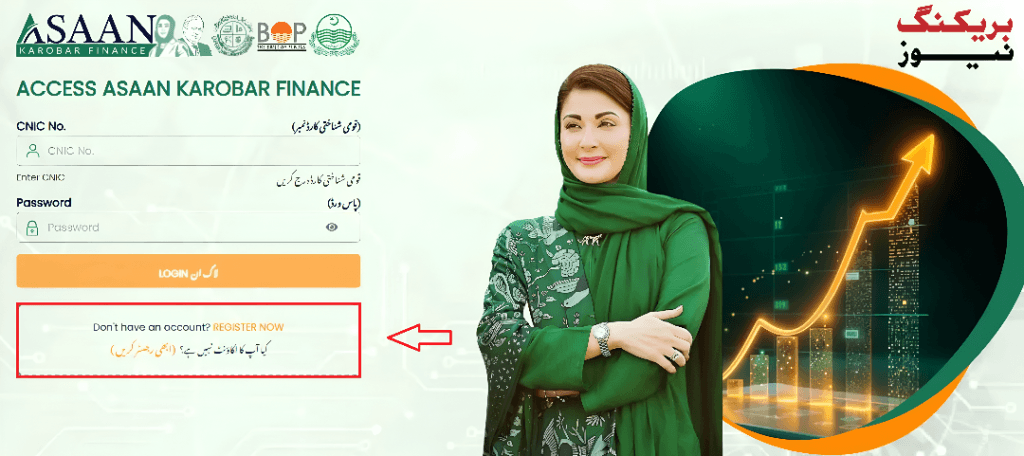

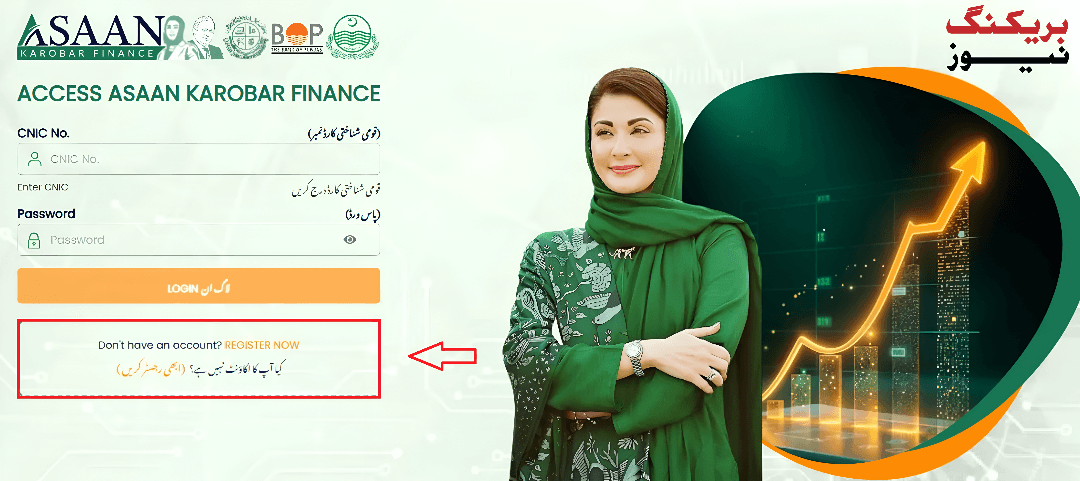

How to Apply for Asaan Karobar Card

Let’s break it down. It’s easy—just follow these steps:

Go to the Official Website

- Visit akc.punjab.gov.pk

- Click “Register” or “Apply.”

Fill Your Details

- Name, father’s name, CNIC, date of birth

- Mobile number and network

- Set a password

Add Business Info

- Business name, address, and type

- Income, expenses, and loan amount needed

Upload Documents

- CNIC, business proof, bank statement if needed

Pay the Fee

- Pay Rs. 500 online (non-refundable)

Submit and Wait

- Check your details

- Click submit

- You’ll get a message on your phone

Verification

- The bank will call you

- They’ll check your info

Get Your Card

- If approved, you get an ATM card

- Use it for business expenses

Tip: Keep your phone on after applying. The bank will call in 2-4 weeks.

How to Track Your Application

You can check your status online; no need to visit any office:

- Go to akc.punjab.gov.pk

- Log in with your CNIC and password

- Click “Application Status.”

- See if it’s under review, approved, or rejected

If you see an error, don’t panic. Most errors can be fixed—just update your info and try again.

How to Fix Them Common Mistakes

Here’s a quick table to help you avoid problems:

| Error Type | Reason | How to Fix |

|---|---|---|

| Invalid CNIC or Mobile | Not registered or mismatched | Update your CNIC or mobile number |

| Age Not Eligible | Under 21 or over 57 | Only apply if within age limit |

| Business Outside Punjab | Business not in Punjab | Change business address |

| Poor Credit History | Unpaid loans or defaults | Clear dues before applying |

| Psychometric Test Failed | Low test score | Prepare for the test |

| Duplicate Application | Applied more than once | Wait for rejection before reapplying |

| Application Rejected | Wrong documents or info | Fix errors and reapply |

Tip: If you get stuck, call the helpline at 1786. They help a lot!

What Can You Use the Loan For?

You can use the money for:

- Buying stock or inventory.

- Paying rent or bills.

- Upgrading equipment.

- Cash withdrawal (up to 25% of the limit).

- Paying vendors or suppliers

But remember: only use it for your business, not personal stuff.

How to Repay the Loan

- Grace Period: 3 months after you get the card.

- Repayment: 24 equal monthly installments.

- No Interest: Just pay back what you borrowed

Tip: Always pay on time. Late payment means extra charges.

Asaan Karobar Card vs. Other Schemes

You might have heard about other schemes like Kisan Card, Qarz-e-Hasna, or Apna Karobar.

Here’s how they compare:

| Scheme | Who Can Apply | Purpose | Loan Amount | Interest Rate |

|---|---|---|---|---|

| Asaan Karobar Card | Small business owners | Business loan | Up to Rs. 1 million | 0% |

| Kisan Card | Farmers | Farming support | Varies | 0% or low |

| Qarz-e-Hasna | Low-income families | Personal loan | Small amounts | 0% |

| Apna Karobar Scheme | Small businesses | Business loan | Varies | 0% or low |

Tip: Always check which scheme fits your needs.

How to Apply for Kisan Card in Pakistan

Since you asked, here’s a quick guide:

- Go to the official Kisan Card website

- Register with your CNIC and land proof

- Fill in your detail

- Upload document

- Submit and wait for approval

Tip: Kisan Card is for farmers, not for all businesses.

How to Apply for Qarz-e-Hasna Scheme

If you need a personal loan, try Qarz-e-Hasna:

- Check eligibility (low income, clean record)

- Visit the local Ehsaas center

- Fill out the form

- Wait for home verification

- Get the loan if approved

Tip: This is for people who really need money, not for business.

Documents Required for Thayi Card in Karnataka

This is not related to Punjab, but since you asked:

- Domicile proof of Karnataka

- BPL or ration card

- SC/ST caste certificate

- Aadhar card

- Mobile number

Tip: Thayi Card is for pregnant women in Karnataka, not for business loans.

How to Apply for Thayi Card in Karnataka

- Visit an Anganwadi center

- Get help from a health worker

- Submit your documents

- Wait for approval

How to Write a Fee Concession Application

Not related to business loans, but here’s a quick tip:

- Write a simple letter

- Explain why you need the concession

- Attach your documents

- Submit to the right office

Tip: Be honest and clear.

How to Apply for a Baladiya Card Online

This is for other countries, but if you ever need it:

- Go to the official website

- Register and upload documents

- Submit and wait for approval

How to Apply for a Karmika Card Online

Again, not for Punjab, but:

- Check eligibility

- Register online

- Upload documents

- Submit and wait

Apna Karobar Scheme vs. Asaan Karobar Card

Both help small businesses. But the Asaan Karobar Card is only for Punjab. Apna Karobar is for other areas or different banks.

Personal Experience

Last month, my friend Ali applied for the Asaan Karobar Card. He was nervous, but he followed the steps. He kept his phone on, uploaded clear documents, and got approved in 3 weeks. Now his shop is doing great!

Tip: Don’t be afraid to ask for help if you’re stuck.

Why This Scheme Is a Game-Changer

It’s not just about money. It’s about hope. Thousands of people are starting or growing their businesses because of this card. The government is really helping small business owners.

Tip: If you’re eligible, don’t wait. Apply today!

Tips for a Smooth Application

- Check your CNIC and mobile number

- Keep your phone on after applying

- Upload clear copies of your documents

- Check your application status regularly

- Call the helpline if you have any problems

What If Your Application Is Rejected?

Don’t worry. Most errors can be fixed. Just check what went wrong, update your information, and apply again. The helpline is always there to help.

FAQs

What documents are needed?

You need your CNIC, registered mobile number, business proof, and sometimes a bank statement.

How do I check my application status?

Go to akc.punjab.gov.pk, log in with your CNIC and password, and click “Application Status.”

What if my application is rejected?

Check the error, fix it, and apply again. Most problems are easy to solve.

How much loan can I get?

Up to Rs. 1 million (10 lakh) with the Asaan Karobar Card.

Is there any interest on the loan?

No, the loan is interest-free. You only pay back what you borrow.

How long does it take to get approved?

Usually 2-4 weeks, depending on verification.

Conclusion

The Asaan Karobar Card is a golden chance for small business owners in Punjab. It’s easy to apply, there’s no interest, and you get money fast. Follow the steps, avoid mistakes, and you’ll be on your way to business success. Don’t wait—apply today and see your business grow!