PM Youth Business & Agriculture Loan Scheme 2025: Application & Benefits Explained

Dreaming of starting your own business or boosting your farm? The Prime Minister’s Youth Business & Agriculture Loan Scheme (PMYB&ALS) is a golden ticket for young Pakistanis. Let’s break it down in plain, simple language—no jargon, just real talk.

What Is the PM Youth Business & Agriculture Loan Scheme?

This scheme is a government effort to help young people start or grow their own businesses and farms. It offers loans from Rs. 500,000 up to Rs. 7.5 million with low or no interest, depending on how much you borrow. The goal? Empower youth, create jobs, and boost the economy.

Why Should You Care?

Most young people have great ideas but lack money. Banks can be tough. This scheme? Easy, online, and made for you. If you qualify, you get a loan with flexible terms and low interest. It’s a real chance to chase your dreams.

Who Can Apply? (Eligibility Criteria)

Here’s who can apply:

Loan Tiers and Amounts

The scheme has three main tiers:

| Tier | Loan Amount | Interest Rate |

|---|---|---|

| 1 | Up to Rs. 500,000 | 0% |

| 2 | Rs. 500,001–1.5M | 5% |

| 3 | Rs. 1.5M–7.5M | 7% |

You can use the loan for almost any business or farm need.

How to Apply Online (Step-by-Step Guide)

Applying is simple. Here’s how you do it:

Visit the Official Website

- Go to pmyp.gov.pk or pmybals.pmyp.gov.pk

- Look for the “Apply Now” or “New Applicant” button.

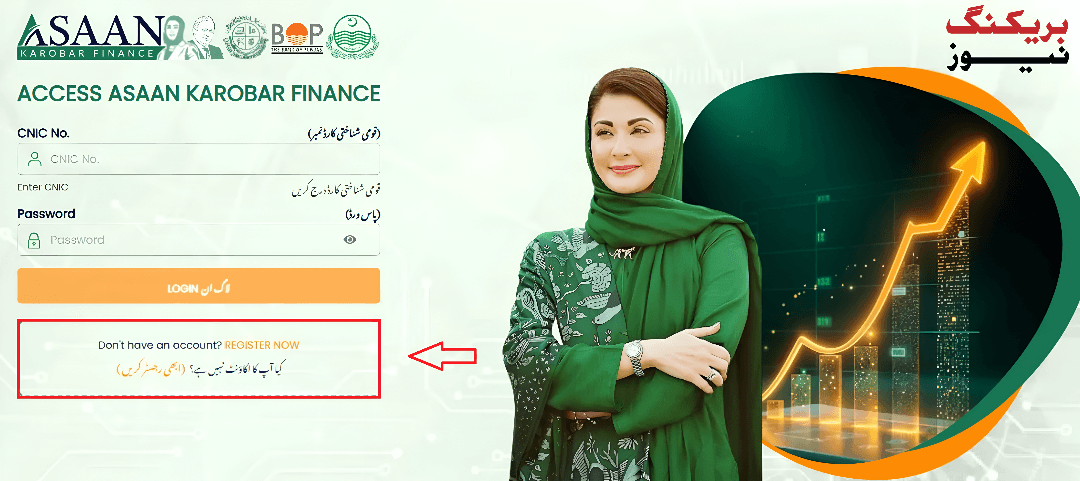

Register Your Account

- Fill in your name, CNIC, date of birth, and mobile number.

- Set a password and confirm it.

Log In

- Use your CNIC and password to log in.

Fill in Personal and Business Details

- Add your address, business type, and business plan.

- If you’re starting new, just describe your idea.

Select Loan Tier

- Choose how much you need (Tier 1, 2, or 3).

Add References

- Give details of two non-relatives (name, CNIC, mobile).

Upload Documents

- Attach your CNIC (front and back), proof of address, and business proof if you have one.

- For IT/e-commerce, add your matric certificate.

Review and Submit

- Double-check everything.

- Click “Submit.”

- Pay the Rs. 100 processing fee online

Wait for Verification

- Your application will be checked.

- You’ll get updates via SMS or email.

Get Your Loan

- If approved, you’ll get the loan amount in your bank account.

- Use it for your business or farm as planned.

How to Check Your Application Status Online

Wondering where your application stands? Easy. Just log in to the official website and check your status. You can also get updates via SMS. No need to visit any office—everything’s online.

What Can You Use the Loan For?

You can use the loan for:

Documents You Need

Before you start, gather these:

Tips for a Smooth Application

What Happens After You Get the Loan?

Special Features and Benefits

What If You’re Not Eligible?

Don’t worry. There are other schemes like the Asaan Karobar Card, Ehsaas Program, and more. Keep looking for opportunities that fit your situation.

Why This Scheme Is a Game-Changer

This loan scheme is more than just money. It’s about giving young people a real shot at success. With easy terms, low interest, and quick processing, it’s a big help for anyone with a dream.

How to Make the Most of Your Loan

Once you get the loan, use it wisely. Invest in your business or farm, keep records, and pay back on time. This will help you grow and maybe even apply for more support in the future.

What Others Are Saying

Many young people have already used this scheme to start or grow their businesses.

The government has given out over Rs. 209 billion to more than 31,700 young entrepreneurs in just eight months. That’s a lot of dreams coming true!

Common Mistakes to Avoid

How to Get Help

If you’re stuck, check the official website or call the helpline. You can also visit a participating bank for guidance. Don’t be shy—ask for help if you need it.

What’s Next? & A Little Humor

Once you get your loan, focus on your business or farm. Keep learning, keep growing, and don’t be afraid to dream big. This scheme is just the beginning.

Loans and farming have something in common—both need the right seeds to grow. (Just don’t plant your loan in the ground!)

My Experience with the PM Youth Loan Scheme

Last year, my friend Ali applied for this loan. He runs a small poultry farm in Lahore. The process was smooth—just a few steps online, a small fee, and some waiting. After a month, he got the money and used it to buy new equipment. Now, his farm is growing fast!

Quick Facts

FAQs

How much can I borrow?

You can get up to Rs. 7.5 million, depending on your business needs.

Is the loan really interest-free?

Yes, for loans up to Rs. 500,000. For higher amounts, the interest is 5% or 7%.

How do I check my application status?

Log in to the official website or check your SMS for updates.

Can I apply if I live in a village?

Yes, as long as you’re a Pakistani citizen and meet the other requirements.

What documents do I need?

CNIC, proof of address, business proof (if any), matric certificate (for IT/E-commerce), and references.

Is there a last date to apply?

There’s no fixed last date, but it’s best to apply as soon as possible—schemes like this can fill up fast.

Final Thoughts

The PM Youth Business & Agriculture Loan Scheme is a real chance for young Pakistanis.

It’s simple, fast, and made for you.

If you’re eligible, don’t wait—apply today and take the first step toward your dreams.