PM Youth Business & Agriculture Loan Scheme: Eligibility & Requirements Guide

If you’re a young person in Pakistan dreaming of starting your own business or growing your farm, the PM Youth Business and Agriculture Loan Scheme (PMYB&ALS) is a big chance. But before you jump in, let’s make sure you know exactly what you need to apply.

What Is the PM Youth Business and Agriculture Loan Scheme?

This scheme is a government program to help young people start or grow businesses and farms. It offers loans from PKR 500,000 up to PKR 7.5 million with low interest rates and easy terms. The goal? Empower youth and boost the economy.

Why Should You Care?

Most young people have great ideas but lack money. Banks can be tough. This scheme is different—it’s easy, online, and made for you. If you qualify, you get a loan with flexible terms and low interest. It’s a real chance to chase your dreams.

Who Can Apply for PMYB&ALS?

Let’s keep it simple. You can apply if you:

What Are the Main Requirements?

Here’s what you need to have before you start your application:

1. Age and Nationality

You must be a Pakistani citizen and within the right age range. For IT/e-commerce, you can be as young as 18 if you have at least matriculation.

2. Valid CNIC

Your computerized national identity card must be valid and up-to-date. This is your main ID for the application.

3. Not a Government Employee

If you work for the government, you can’t apply. This scheme is for private citizens and entrepreneurs.

4. Business Idea or Existing Business

You must have a business idea or already run a business or farm. Both startups and existing businesses are welcome.

5. Education (For IT/E-Commerce)

If you’re applying for IT or e-commerce, you need at least matriculation or equivalent education.

6. No Criminal Record or Bad Credit

You should have a clean credit history and no major legal issues. Banks will check this.

What Documents Do You Need?

Here’s a list of documents you’ll need to upload or show:

Make sure all documents are clear, readable, and up to date.

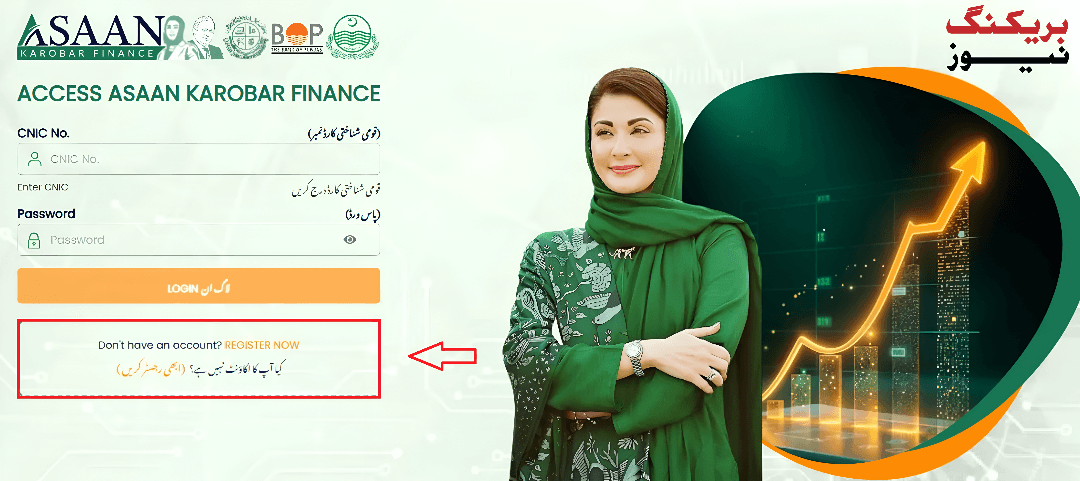

How to Apply Online for PMYB&ALS

Applying is easy and only online. Here’s how you do it:

Visit the Official Website

Register or Log In

Select Loan Tier

Fill in Personal Information

Fill in Qualification Details

Add Contact Details

Fill in Business Information

Add Financing Details

Upload Documents

Add References

Review and Submit

What Happens After You Apply?

Your application goes through several checks:

If everything is okay, your loan will be approved. You’ll get the money in your bank account.

How to Track Your Application Status

You can check your status online at pmyp.gov.pk. Log in to your account and look for the “Application Status” section. You’ll see if your application is under review, approved, or rejected.

What Are the Loan Tiers and Amounts?

Here’s a quick table to show the different loan tiers:

| Tier | Loan Amount | Interest Rate | Repayment Period |

|---|---|---|---|

| 1 | Up to PKR 500,000 | 0% | Up to 8 years |

| 2 | PKR 500,001–1.5M | 5% | Up to 8 years |

| 3 | PKR 1.5M–7.5M | 7% | Up to 8 years |

You can choose the tier that fits your needs.

Tips for a Smooth Application

My Experience with the PMYB&ALS Application

Last year, my cousin applied for the Tier 2 loan. He runs a small poultry farm in Lahore. The process was smooth—just a few steps online, a small fee, and some waiting. After a month, he got the money and used it to buy new equipment. Now, his farm is growing fast!

Quick Facts

Common Mistakes to Avoid

What If Your Application Is Rejected?

If your application is rejected, check the reason. Fix any errors and reapply if you can. Sometimes, a small mistake can cause rejection, but you get a chance to correct it.

How to Track Your Loan Repayment

Once you get the loan, you can track your repayment online. The official portal has a loan repayment calculator to help you plan your payments.

Why This Scheme Is a Game-Changer

This loan scheme is more than just money. It’s about giving young people a real shot at success. With easy terms, low interest, and quick processing, it’s a big help for anyone with a dream.

What Others Are Saying

Many young people have already used this scheme to start or grow their businesses. The government has given out billions of rupees to thousands of young entrepreneurs. That’s a lot of dreams coming true!

A Little Humor

Applying for a loan is like baking a cake—one wrong ingredient and it doesn’t turn out right. But with this guide, you’ll get the recipe just right!

FAQs

What documents do I need to Apply?

You’ll need your CNIC, proof of address, business proof, references, and a passport-size photo.

How do I apply online?

Go to pmyp.gov.pk, register or log in, fill in your details, upload documents, and submit your application.

What is the last date to apply?

There’s no fixed last date, but it’s best to apply as soon as possible.

Can I check my application status online?

Yes, you can check your status by logging in to pmyp.gov.pk.

What if I am a government employee?

Government employees are not eligible to apply.

How much can I borrow?

You can borrow from PKR 500,000 up to PKR 7.5 million, depending on your needs.

Conclusion

Applying for the PM Youth Business and Agriculture Loan Scheme is easy if you follow these steps. Don’t let small mistakes stop you from getting the support you need. Take your time, fix any errors, and give your business a fresh start.