Punjab CM Maryam Nawaz Launches Asaan Karobar Card Scheme

Big news for small business owners in Punjab! Chief Minister Maryam Nawaz has launched the Asaan Karobar Card Scheme. It’s a game-changer for anyone dreaming of starting or growing a business. how it works, and why you should care.

Loan Calculator

Calculation Results

- Tier 1: PKR 100,000 - 5,000,000 (Processing Fee: PKR 5,000)

- Tier 2: PKR 5,000,000 - 30,000,000 (Processing Fee: PKR 10,000)

- Interest Rate: Competitive rates as per SBP guidelines

- Repayment: Flexible monthly installments

📱 1786 (Toll Free)

🕒 9:00 AM - 5:00 PM

📍 Punjab Small Industries Corporation

Lahore, Punjab

What is the maximum loan amount?

What documents are required?

How long does the approval process take?

Personal Documents:

- CNIC (Front & Back)

- Passport Size Photo

- Income Certificate

- Bank Statements (6 months)

Business Documents:

- Business Registration

- Trade License

- Tax Returns (2 years)

- Business Plan

What the Buzz About Punjab CM New Scheme for 2025?

Maryam Nawaz new scheme is all about supporting small and medium businesses. The Asaan Karobar Card gives you access to big loans—no interest, no hidden charges. It’s part of a bigger plan to boost jobs and help Punjab’s economy grow.

This scheme is for everyone: men, women, transgender people, and special persons. If you’re between 21 and 57 and live in Punjab, you can apply. No need to stress about complicated paperwork or long waits.

Is the Punjab Bank Carry Daba Scheme 2025?

Actually, no. The “carry daba” scheme isn’t official, but the Asaan Karobar Card is real. It’s a government-backed business card that gives you money to start or expand your business. Think of it as a friend lending you cash—without asking for a share.

CM Punjab Car Scheme vs. Business Card Scheme

Some people mix up the car scheme with the business card scheme. The Asaan Karobar Card is for business growth. It helps you buy stock, pay bills, and even withdraw cash for your business needs.

Why Does the CM Punjab New Scheme Matter?

Maryam Nawaz’s new scheme is a big deal. It’s designed to make life easier for small business owners. With this card, you get up to 10 lakh rupees as an interest-free loan. Payments are in easy installments, so you don’t have to worry about big monthly bills.

Asaan Karobar Card Scheme 2025: Key Features

Here’s what makes this scheme special:

- Interest-free loans: Up to 10 lakh rupees

- Easy installments: Pay back over three years

- No hidden charges: What you see is what you get

- For everyone: Men, women, transgender, special persons

- Online application: Apply from home, no office visits

- Quick approval: Get your card fast if you qualify

Maryam Nawaz Card Scheme Launch

At the launch event, Maryam Nawaz explained how this scheme will help Punjab’s economy. She said it’s about giving people a chance to succeed. The government is also offering land at low prices for new businesses.

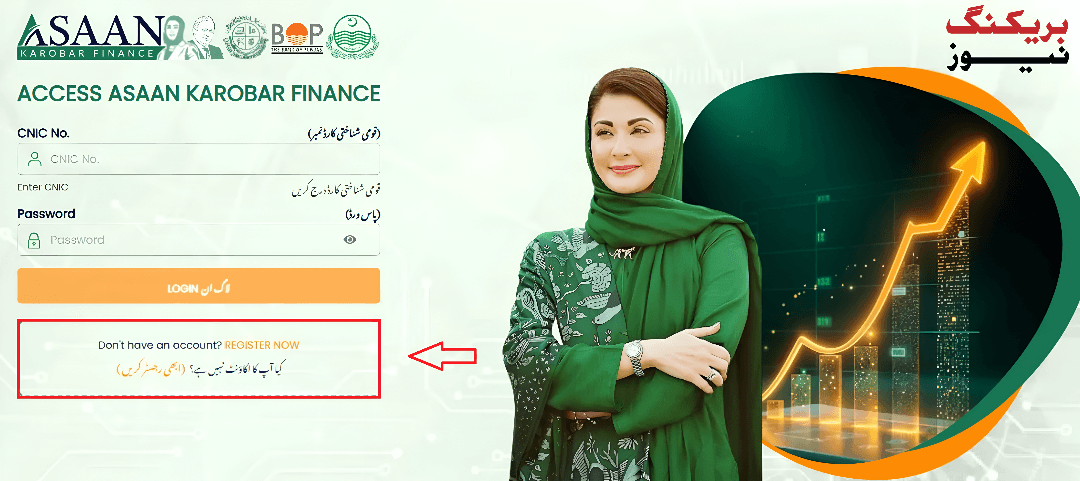

How to Apply for Punjab Government Card Scheme

Applying is easy. Just go to the official website (akc.punjab.gov.pk), fill in your details, and upload your documents. You’ll get a confirmation and can track your application online. If you need help, call the helpline at 1786.

Who Benefits from Asaan Karobar for Small Businesses?

This scheme is perfect for small business owners and startups. Whether you sell clothes, run a bakery, or have a tech idea, you can get the support you need. The goal is to help you grow, not just survive.

Eligibility Maryam Nawaz Punjab Card Scheme

To apply, you need to:

- Be 21–57 years old

- Live in Punjab

- Have a valid CNIC and mobile number

- Own or plan to start a business in Punjab

- Not be a defaulter on any loans

Asaan Karobar Card for Entrepreneurs Is it for you?

Entrepreneurs get a big boost with this card. You can use the money for anything your business needs: stock, rent, bills, or even marketing. The government wants you to succeed, so they’ve made the process simple and fast.

How It Works Punjab CM Business Card Scheme

Once you get your card, you can withdraw cash, pay vendors, and even pay government fees. Up to 25% of the loan can be taken out as cash. The rest is for business expenses, so you stay focused on growth.

Big Plans Asaan Karobar Launch by Maryam Nawaz

Maryam Nawaz wants to see more businesses in Punjab. She’s also planning to give out land in industrial zones and free solar systems for export businesses. The idea is to make Punjab a hub for new ideas and jobs.

Maryam Nawaz Business Support Scheme More Than Just Money

This scheme isn’t just about cash. It’s about support. The government will help you get licenses and NOCs so you can start your business right away. No more waiting for approvals or running around offices.

The government is working hard to make this scheme a success. They’ve already approved thousands of applications and are delivering ATM cards to successful applicants. If you haven’t applied yet, now’s the time.

Karobar Card Scheme Punjab 2025: Key Points

- No interest: Only pay back what you borrow

- Easy application: Online, no office visits

- Fast approval: Get your card in days

- For all: Men, women, transgender, special persons

- Support: Help with licenses and NOCs

How to Use Your Business Card Scheme by Punjab CM

Once you have your card, you can use it like any other debit card. Pay bills, buy stock, and even withdraw cash. Just remember to use the money for your business, not personal expenses.

Asaan Karobar for Business Growth Real Stories

I’ve seen people use this card to start bakeries, clothing shops, and tech startups. One friend doubled his sales in just six months. Another opened a new branch. The card gives you the boost you need to grow.

This scheme stands out because it’s simple, fast, and fair. No need for big guarantees or long waits. The government trusts you to use the money wisely and grow your business.

How to Check Your Status Punjab Government Business Cards

You can check your application status online. Just log in to the official portal with your CNIC and password. If you’re approved, you’ll get your card in the mail or via courier.

What’s the Process for the Business Card Scheme in Punjab?

- Apply online

- Upload your documents

- Pay a small fee

- Wait for approval

- Get your card and start your business

Who Is Eligible for Asaan Karobar Punjab Entrepreneurs?

If you’re an entrepreneur in Punjab, you’re eligible. You just need a business idea or an existing business. The scheme is designed to help you take the next step, whatever that may be.

How Can Punjab Businesses Make the Most of the Karobar Card?

To get the most from your card, use the money wisely. Invest in your business, pay your bills on time, and keep track of your expenses. The government is here to help, but success is up to you.

It Safe Government Business Card Scheme Pakistan

Yes, it’s safe. The scheme is run by the Punjab government and the Bank of Punjab. Your money is secure, and the process is transparent. If you have any issues, call the helpline at 1786.

How Much Can You Get from Asaan Karobar Punjab Financial Support?

You can get up to 10 lakh rupees as an interest-free loan. Larger loans are available under the Asaan Karobar Finance Scheme, but the card is for small businesses and startups.

Business Growth Punjab CM Scheme Secret?

The government is giving you the tools you need to grow. All you have to do is take the first step and apply.

How to Apply for Asaan Karobar for Punjab Startups

Applying is easy. Go to akc.punjab.gov.pk, fill in your details, and upload your documents. You’ll get a confirmation and can track your application online. If you need help, call 1786.

Quick Facts

- Interest-free loans up to 10 lakh rupees

- Easy installments over three years

- Online application, no office visits

- For men, women, transgender, and special persons

- Support with licenses and NOCs

- Helpline: 1786

Tips and Tricks

- Apply early to avoid delays

- Keep your documents ready

- Use the money for your business, not personal expenses

- Pay your installments on time

- Call the helpline if you have any issues

FAQs

How much loan can I get?

Up to 10 lakh rupees as an interest-free loan

How do I apply for the Asaan Karobar Card?

Apply online at akc.punjab.gov.pk or call the helpline at 1786

What can I use the loan for?

You can use it for business expenses like stock, rent, bills, and marketing

Is there any interest on the loan?

No, the loan is interest-free

How long do I have to pay back the loan?

You have up to three years to pay back in easy installments

What if I have a problem with my application?

Call the helpline at 1786 for help

The Asaan Karobar Card Scheme is a big opportunity for small business owners in Punjab. With interest-free loans, easy application, and government support, there’s never been a better time to start or grow your business. Don’t miss out—apply today and take the first step toward success!