Punjab No-Interest Business Loans & PSIC Guide Application

Chaudhry Shafay Hussain—the Provincial Minister for Industries and Commerce in Punjab—chaired the 131st meeting of the Punjab Small Industries Corporation (PSIC) board in Lahore. This isn’t just a boring meeting; it matters to real people. Why? Because this group decides how to help small businesses, new factories, and local entrepreneurs.

They approved a huge budget—Rs. 11.483 billion for 2025–26—for new and ongoing projects, especially industrial estates in Gujrat, Sialkot, Chakwal, Daska, and Sambarial. Oh, and they checked on the famous Chief Minister’s Asaan Karobar Finance and Asaan Karobar Card schemes.

Loan Calculator

Calculation Results

- Tier 1: PKR 100,000 - 5,000,000 (Processing Fee: PKR 5,000)

- Tier 2: PKR 5,000,000 - 30,000,000 (Processing Fee: PKR 10,000)

- Interest Rate: Competitive rates as per SBP guidelines

- Repayment: Flexible monthly installments

📱 1786 (Toll Free)

🕒 9:00 AM - 5:00 PM

📍 Punjab Small Industries Corporation

Lahore, Punjab

What is the maximum loan amount?

What documents are required?

How long does the approval process take?

Personal Documents:

- CNIC (Front & Back)

- Passport Size Photo

- Income Certificate

- Bank Statements (6 months)

Business Documents:

- Business Registration

- Trade License

- Tax Returns (2 years)

- Business Plan

- How to Check Your Asaan Karobar Finance Application Status

- Govt of Punjab Announces Latest Rescue 1122 Jobs 2026—Apply Online

- 3737 Ramzan Package 2026 | 9999 & 8070 Online Registration

- Ramzan Package 2026—8171 BISP 14500 & 9999 Online Registration

- Asaan Karobar 2026 Apply Online for Business Loans Up to 3 Crores

- PSER Survey Online Registration for Ramzan Package & Free Atta Rashan 2026

- ASA Pakistan Microfinance | Fast Credit Approval | Loan Application 2026

- Ramzan Package 2026 – Eid Ul Fitr Program 25000 Online Application

- Apply for CM Punjab Asaan Karobar Card Loan & Maryam Nawaz Loan Scheme 2026

Ch. Shafay Hussain pointed out that these loans—given without interest—are working for small businesses. The recovery rate (how many people pay back on time) is super high: 99% for the Finance Scheme and 95% for the Card Scheme. That’s rare—most government loan programs struggle with repayments.

Who Should Care? (Why This Matters to You)

Dreaming of starting your own business? No capital? Scared of bank interest? The Punjab government loan PSIC schemes are a game-changer for everyday folks—shopkeepers, students, women entrepreneurs, and even farmers.

It was about empowering the youth, creating jobs, and making Punjab’s economy competitive. If that sounds vague, here’s what it means: easy loans, no strings attached, for real people.

Chief Minister Asaan Karobar Finance Big Picture

Asaan Karobar means “Easy Business” in Urdu. The Chief Minister’s Asaan Karobar Finance Scheme is Punjab way of helping small businesses get money quickly, with minimal paperwork and—wait for it—ZERO interest. That last point? Yeah, you heard right. No hidden costs, no “Service charges,” just money to start or grow your business.

Tier-1 loans (up to Rs. 5 million) don’t even need collateral. Tier-2 loans (Rs. 5 million to Rs. 30 million) need some security, but the main idea is to help entrepreneurs from every sector—from motorbike mechanics to chicken farms to home bakeries.

Eligibility? You need to be between 25 and 55, have a clean credit history, and either own or rent your business location. Repayment can be over five years—with a grace period of six months for new businesses and three months for existing ones.

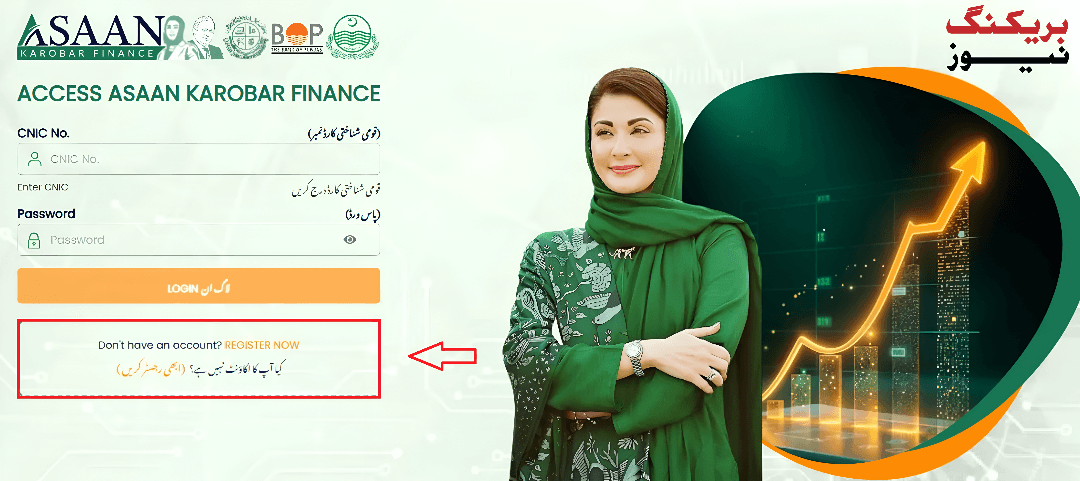

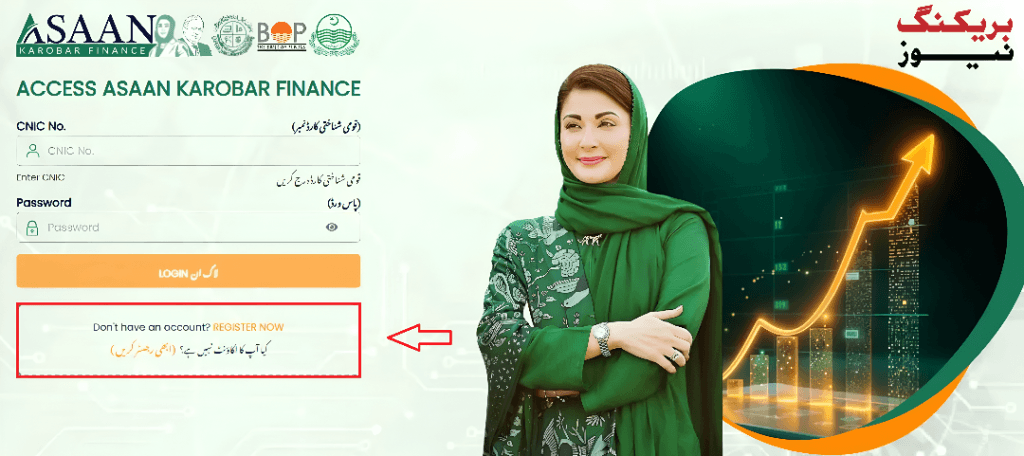

How to Apply for Asaan Karobar PSIC Loan Scheme 2025 Online

So, you’re convinced. You want a piece of that zero-interest pie. Here’s what you do:

- Visit akc.punjab.gov.pk: This is the official portal for both the Asaan Karobar Finance Scheme and the Karobar Card.

- Click “Apply Now.” Fill in your basic info—name, CNIC, business type, experience, etc.

- Upload the required documents: a copy of your CNIC, proof of business (e.g., rent agreement, ownership documents, or business registration), and sometimes a simple business plan.

- Submit and wait. Your application will be checked, and if all’s good, you’ll get a message for an interview or document verification.

- Check your status: There a way to check your Asaan Karobar Card status online, too—just visit the same portal and enter your details.

- Get your loan: If approved, the money goes directly to your account—minus the usual “bank hassle.”

Tip: The process is online, but if you’re confused, there are helpline numbers and videos on YouTube explaining each step—just search “Asaan Karobar loan apply online.”

Asaan Karobar Finance Scheme at a Glance

| Feature | Tier-1 Loan (Unsecured) | Tier-2 Loan (Secured) |

|---|---|---|

| Loan Amount | Up to Rs. 5 million | Rs. 5–30 million |

| Interest Rate | 0% | 0% |

| Collateral Required | No | Yes |

| Repayment | Up to 5 years | Up to 5 years |

| Grace Period | 6 months (new business) | 3 months (existing) |

| Who Can Apply | Entrepreneurs, women, youth, everyone | Entrepreneurs, small/medium industries |

| Apply Online? | akc.punjab.gov.pk | akc.punjab.gov.pk |

What Exactly Does the “Asaan Karobar Card” Do?

The Asaan Karobar Card is like a debit/credit card—but only for business purchases. With this card, you get a loan (Rs. 10,000 to Rs. 1 million, sometimes up to Rs. 10 lakh) for buying machinery, raw materials, or anything your business needs.

You can apply online at the same portal. The process is similar—fill in details, upload docs, and submit. The biggest plus? No middleman, no agent—just direct access to funds.

Once approved, you use the card at registered vendors or suppliers. Every purchase is tracked, and you only pay back what you spend—slowly, over three years, with zero interest. It’s a smart way to keep your business flow smooth without begging for bank loans from PSIC.

Punjab’s Loan Schemes: Beyond Asaan Karobar

The Punjab government isn’t just stopping at interest-free loans. There are more perks:

- Solar panels and green energy support: Get subsidies for converting your business to solar power—up to Rs. 50 lakh for industries in export zones.

- Industrial estates: the government is building special zones in Sialkot, Gujrat, and Quaidabad for businesses to set up shop easily, with lower land rates.

- Round 2 in 2025–26: The next phase of these schemes will have a budget of Rs. 100 billion, helping about 24,000 more businesses.

- No red tape: PSIC loans, you don’t even need NOCs or building maps—just proof you’re serious about your business.

Bottom line: If you’re in Punjab and want to start or expand a business, it’s probably the easiest time in history to do it.

What’s the salary of Pakistan’s finance minister?

Honestly, it’s not public for the federal minister. Before joining, Muhammad Aurangzeb was earning PKR 30 million per month as a banker—so you know the pay isn’t peanuts, but it’s not broadcasted by the government.

FAQs

What is the Asaan Karobar Finance Scheme?

It’s a Punjab government loan program for small businesses—interest-free, easy to apply for, and designed for entrepreneurs who find it hard to get regular bank loans.

How do I apply for the CM Punjab Loan Scheme 2025?

Go to akc.punjab.gov.pk, fill out the online form, upload your documents, and submit. You’ll get updates via SMS and can check your status online.

What’s the difference between Asaan Karobar Card and Asaan Karobar Finance?

- Finance Scheme: Larger loans for business setup, expansion, machinery, etc.

- Card Scheme: Smaller, card-based loans for business expenses—like buying goods, paying suppliers, etc. Both are interest-free and managed through the Bank of Punjab.

Who is eligible for the Asaan Karobar Scheme?

- Age 25–55

- Pakistani citizen, living in Punjab

- No criminal record

- Clean credit history

- Own or rent business premises

- Women, youth, and all sectors welcome

Can I check my Asaan Karobar Card application status online?

Yes. Visit the same portal (akc.punjab.gov.pk) and enter your tracking info.

What is PSIC, and how does it help ordinary people?

PSIC is the Punjab Small Industries Corporation. It runs industrial estates, gives loans, and supports small business owners across Punjab. That’s why meetings like the one chaired by Ch. Shafay Hussain directly impact ordinary citizens—especially those trying to start or expand a business.

Final Thoughts

Government meetings sound boring. But with PSIC, the Asaan Karobar schemes, and leaders like Ch. Shafay Hussain, real people are getting real chances. This isn’t a politician fantasy—it’s working for shopkeepers, students, women, and yes, even small-time electricians.