Tier 2 PM Youth Business & Agriculture Loan Scheme: Complete Application Guide

Ever wanted to start or grow your own business but didn’t have the money? The Tier 2 PM Youth Business and Agriculture Loan Scheme (PMYB&ALS) is here to help. It’s a government-backed loan program for young entrepreneurs in Pakistan. Let’s break down how you can apply, step by step.

What Is the PM Youth Business and Agriculture Loan Scheme?

This scheme is a government initiative to help young people start or expand their businesses or farms. It offers loans from PKR 500,000 up to PKR 7.5 million, depending on your needs. The Tier 2 loan is for amounts above PKR 500,000 and up to PKR 1.5 million.

Why Should You Care?

Tier 2 is perfect if you need a bigger boost for your business or farm. The interest rate is low—just 5% per year—and you can repay the loan over up to 8 years. That’s a lot of time to grow your business without worrying about big monthly payments.

Who Can Apply for Tier 2?

You can apply if you:

What Can You Use the Loan For?

You can use the loan for:

What Documents Do You Need?

Before you start, gather these:

Make sure all documents are clear and easy to read.

How to Apply Online for Tier 2 PM Youth Business and Agriculture Loan Scheme

Here’s the step-by-step process. You can do this from your phone or computer—no need to visit any office.

Step 1: Visit the Official Website

Go to pmyp.gov.pk or pmybals.pmyp.gov.pk. This is the official portal for the PM Youth Business and Agriculture Loan Scheme

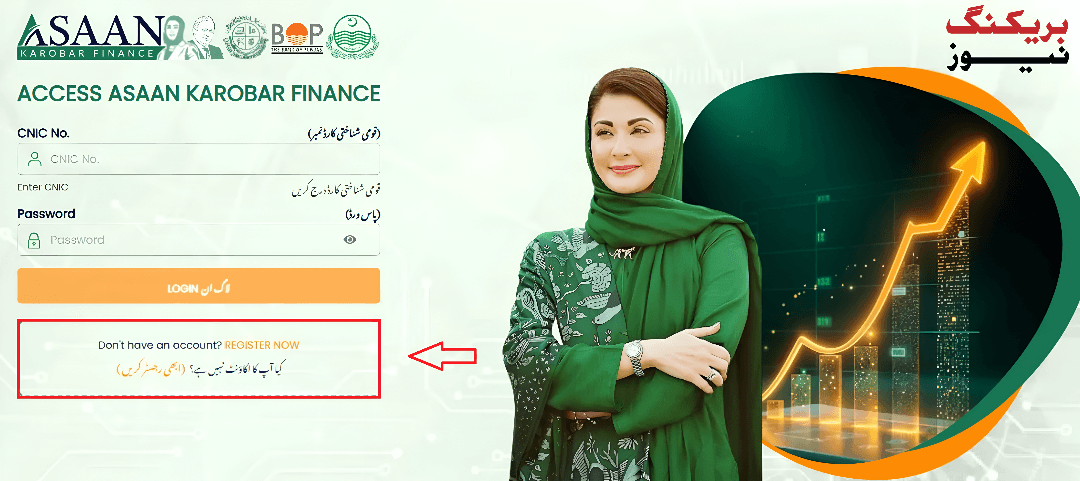

Step 2: Register or Log In

If you’re new, click “Register” or “New Applicant.” Fill in your details: name, CNIC, date of birth, mobile number, and set a password. If you already have an account, just log in.

Step 3: Select Tier 2 Loan

On the dashboard, find the option to apply for a loan. Choose “Tier 2” (PKR 500,001 to PKR 1.5 million).

Step 4: Fill in Personal Information

Enter your personal details: name, address, marital status, and contact info. Make sure everything matches your CNIC.

Step 5: Fill in Qualification Details

If you have any education or certificates, add them here. For IT or e-commerce, you need at least matriculation.

Step 6: Add Contact Details

Enter your phone number and email. Your mobile number must be registered with your CNIC.

Step 7: Fill in Business Information

Tell them about your business: name, type, address, monthly income, and expenses. If you’re starting new, describe your business idea.

Step 8: Add Financing Details

Enter how much you need (between PKR 500,001 and PKR 1.5 million) and what you’ll use the money for.

Step 9: Upload Documents

Attach clear scans or photos of your CNIC, proof of address, business proof, and any other required documents.

Step 10: Add References

Give details of two non-relatives (name, CNIC, mobile number). These people may be contacted for verification.

Step 11: Review and Submit

Double-check all your info and documents. Click “Submit.” You’ll need to pay a small processing fee (usually PKR 100).

Step 12: Wait for Bank Notification

After you submit, the bank you chose will review your application. They may contact you for more info or to verify your details.

What Happens After You Apply?

Your application goes through several checks:

If everything is okay, your loan will be approved. You’ll get the money in your bank account.

How to Check Your Application Status

You can check your status online at pmyp.gov.pk. Log in to your account and look for the “Application Status” section. You’ll see if your application is under review, approved, or rejected.

Tips for a Smooth Application

Common Mistakes to Avoid

What If Your Application Is Rejected?

If your application is rejected, check the reason. Fix any errors and reapply if you can. Sometimes, a small mistake can cause rejection, but you get a chance to correct it.

How to Track Your Loan Repayment

Once you get the loan, you can track your repayment online. The official portal has a loan repayment calculator to help you plan your payments.

Why This Scheme Is a Game-Changer

This loan scheme is more than just money. It’s about giving young people a real shot at success. With easy terms, low interest, and quick processing, it’s a big help for anyone with a dream.

What Others Are Saying

Many young people have already used this scheme to start or grow their businesses. The government has given out billions of rupees to thousands of young entrepreneurs. That’s a lot of dreams coming true!

FAQs

What is the interest rate for Tier 2?

The interest rate is 5% per year for Tier 2 loans.

How much can I borrow under Tier 2?

You can borrow between PKR 500,001 and PKR 1.5 million.

How long does it take to get approved?

It usually takes a few weeks, depending on the bank and the volume of applications.

Can I apply if I already have a business?

Yes, both new and existing businesses can apply.

What documents do I need?

You’ll need your CNIC, proof of address, business proof, business plan, and references.

Can I check my application status online?

Yes, you can check your status by logging in to pmyp.gov.pk.

Conclusion

Applying for the Tier 2 PM Youth Business and Agriculture Loan Scheme is easy if you follow these steps. Don’t let small mistakes stop you from getting the support you need. Take your time, fix any errors, and give your business a fresh start.